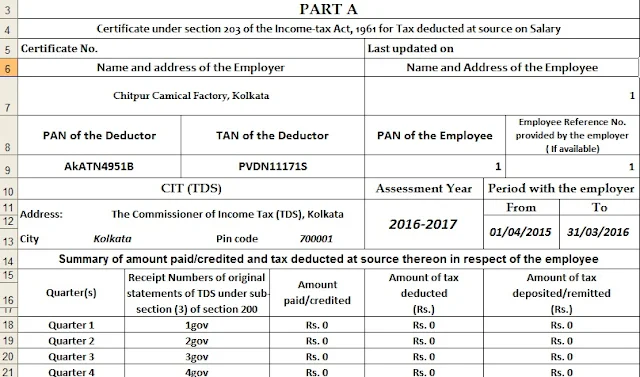

As per the Income Tax Department's New Notification No 11/2013 dated 19/2/2013, the format of Form 16 have already Changed. This Form 16 have divided in two part one of Part A and another Part B. Also this new Form 16 have made some exclusive change and have more column like as Match/Mismatch. Below given the some of the Notification about the New amended Form 16 :-

(43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to

amend the Income-tax Rules, 1962, namely:—

You can download the Automatic Form 16 for the Financial Year 2015-16 & Assessment Year 2016-17, as per the new Budget 2015 amended of Income Tax Section and Slab of Income Tax as per the Finance Budget.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962, (hereinafter referred to as the said rules) in rule 31A,—

(a) in sub-rule (3),—

(A) in clause (i), for item (b), the following items shall be substituted, namely:—

“(b) furnishing the statement electronically under digital signature in accordance with the

procedures, formats and standards specified under sub-rule (5);

(c) furnishing the statement electronically along with the verification of the statement in Form

27A or verified through an electronic process in accordance with the procedures, formats and

standards specified under sub-rule (5)”;

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART-II,

SECTION 3, SUB-SECTION (ii) of dated the 19th February, 2013]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

(CENTRAL BOARD OF DIRECT TAXES)

New Delhi, the 19th February, 2013

NOTIFICATION

INCOME-TAX

S.O.410 (E).— In exercise of the powers conferred by section 295 of the Income-tax Act, 1961(43 of 1961), the Central Board of Direct Taxes hereby makes the following rules further to

amend the Income-tax Rules, 1962, namely:—

You can download the Automatic Form 16 for the Financial Year 2015-16 & Assessment Year 2016-17, as per the new Budget 2015 amended of Income Tax Section and Slab of Income Tax as per the Finance Budget.

1) Click here to Download the Automated Master of Form 16 Part A&B(Amended Version) for the Financial Year 2015-16 and Assessment Year 2016-17[ This Excel Utility can prepare at a time 100 employees Form 16 Part A&B ]

2) Click here to Download the Automated Master of Form 16 Part A&B(Amended Version) for the Financial Year 2015-16 and Assessment Year 2016-17[

This Excel Utility can prepare at a time 50 employees Form 16 Part

A&B ]

1) Click here to Download the Automated Master of Form 16 Part B(Amended Version) for the Financial Year 2015-16 and Assessment Year 2016-17[

This Excel Utility can prepare at a time 100 employees Form 16 Part B ]

1) Click here to Download the Automated Master of Form 16 Part B(Amended Version) for the Financial Year 2015-16 and Assessment Year 2016-17[

This Excel Utility can prepare at a time 50 employees Form 16 Part B ]

1) Click here to Download the Automated Master of Form 16 Part B with 12 BA (Amended Version) for the Financial Year 2015-16 and Assessment Year 2016-17[

This Excel Utility can prepare at a time 50 employees Form 16 Part B with 12 BA]

1. (1) These rules may be called the Income-tax (2nd Amendment) Rules, 2013.

(2) They shall come into force on the date of their publication in the Official Gazette.

2. In the Income-tax Rules, 1962, (hereinafter referred to as the said rules) in rule 31A,—

(a) in sub-rule (3),—

(A) in clause (i), for item (b), the following items shall be substituted, namely:—

“(b) furnishing the statement electronically under digital signature in accordance with the

procedures, formats and standards specified under sub-rule (5);

(c) furnishing the statement electronically along with the verification of the statement in Form

27A or verified through an electronic process in accordance with the procedures, formats and

standards specified under sub-rule (5)”;