As per the Finance Budget for 2016-2017 has enhanced Income

Tax Section salaried employees, farmers and the middle class. The most

important announcement for the middle class people is that one can get rebate

on the purchase of house i.e. Rs. 50,000 rebate if the cost of the home is

below 50 lakh rupees, loan less then 35 lakhs and if this your first

home.

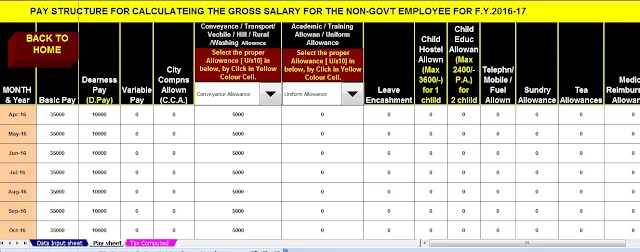

Click here to Download Automated Income Tax Calculator for Non-Govt employees for F.Y.2016-17 & Assessment Year 2017-18 as per Finance Budget 2016

The main changes in the Budget 2016, are given in the table below.

Tax Deduction details referred

to para 99

1.

|

Deduction under sec 80C

|

1,50,000

|

2.

|

Deduction under sec 80 CCD(1B)

|

50,000

|

3.

|

Deduction on account of interest on house

property loan (Self Occupied Property)

|

2,00,000

|

4.

|

Deduction under sec 80D on health insurance

premium

|

25,000

|

5.

|

Exemption of transport allowance

|

19,200

|

6.

|

Total

|

4,44,200

|

The Finance minister in his budgets had only re-jigged the

whole sum of deductions that goes under the different sections of IT Act. This

financial year,

he enhanced the deduction on the premium of health insurance

from 15, 000 rupees to 25,000 rupees.

He as well permitted an additional deduction’ of 50,000

rupees for the investments which made on the NPS.

The allowance on transport permitted as exclusion has been

made twice from 9,600 rupees to 19,200 rupees & Rs. 38,400/- for above 80%

dis-able persons.

An additional tax deduction of Rs. 50,000/- extra for Sec 80C plus 50,000 rupees

additional to invest in NPS plus 50,000 rupees U/s 80EE extra for the interest.