Things to save your tax as per the new

budget, As 1st April 2016 is just about to come, we need to find out ways to save our tax deductions

& also save our tax liability. This is the right time where we can pursue

tax planning & save our tax from being deducted or make investments to save

our tax liability.

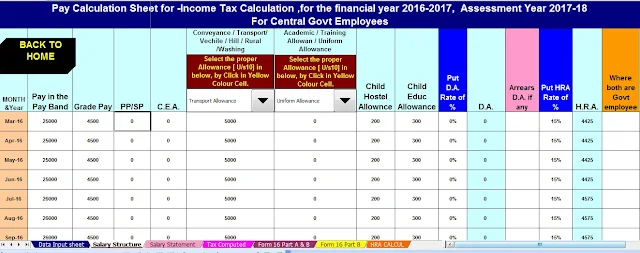

Download Income Tax All in One TDS on Salary for Central Govt employees for Financial Year 2016-17 & Assessment Year 2017-18 as per Budget 2016 [ This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic Calculation of H.R.A. Exemption + Automated Form 16 Part A&B and Form 16 Part B as per Amended by the Finance Budget 2016]

Here is a list of things

you can do to make your money stay with you. This will not just get you tax

saving, but also help you to multiply your money for the long term. You will

not just be under burdened from paying tax, but will also have some savings for

your retirement. Now check more details about “Last Minute Things to save your

tax as per the new budget” from below….

Save your tax as per the new budget 2016

Here are the steps which you can follow:

Step 1: Calculate your projected income:

Be it Income from salary,

Business or profession profits, house property income, capital gains or interest or

dividend income, you need to sum it up. You can then calculate your tax

liability on the same but make sure you calculate it keeping the recent slabs

in mind. Also, if you are not sure of the exact amount, you can select a

proportionate amount of interest, dividend, etc.

Step 2: Calculate your tax liability:

After finalizing your

income, you need to calculate your tax liability. You need to consider the new

budget and then consider the basic exemption slabs accordingly. In the recent

budget, there are not many changes in the various slabs. Only the rebate under section 87A has been increased from 2000/- to

5000/- for the assesses having income below Rs. 5 Lacs.

Step 3: Check for your investments:

You might have made a

few investments like PPF, LIC, etc. during the on-going year. You may also have

an on-going housing loan in which you can claim interest & principal

deductions. You also might have an education loan, on which you are paying installments, etc.

so, now you need to make a list of all your investments & find out the

totals.

Download All in One TDS on Salary for All State Govt employees For Financial Year 2016-17 & Assessment Year 2017-18 [ This Excel Utility can prepare at a time Tax Compute Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic Calculation of H.R.A. Exemption + Automated Form 16 Part A&B and Form 16 Part B as per Amended by the Finance Budget 2016]

Step 4: Scope for investments:

Now, you need to find

out the balance amount which is possible for you to invest & make sure you

have the required funds to invest. You just have 4-5 days in hand, so you need

to take steps at the earliest.

Possible Areas of Investment:

The place where you can

make sure you have already invested or if you want to do now, you can go for

that:

1. PPF: You can contribute a max

up to Rs. 150,000/- in this investment. The interest rate is

between 7 – 8% for this investment.

2. FD: There are tax saver FDs

for 5 years & 10 years available in which the amount you can invest is a

minimum of Rs. 500/- & a max up to Rs. 150,000/-.

3. Medi – Claim: Make sure you have a mediclaim insurance. It is not an investment basically, but

you get deductions up to Rs. 25,000/- for < 60 Years and Rs. 30,000/-for above 60 Year i.e. Sr.Citizen

LIC: You have two options here. There are cum bonus plan in which you get

your LIC money back. Also, there are other plans which just provide a life

cover