Budget 2016-17 has already passed by the Parliament. The Finance Minister has kept the

Personal Income Tax

slab rates unchanged for the

Financial Year 2016-17 (Assessment Year 2017-2018).

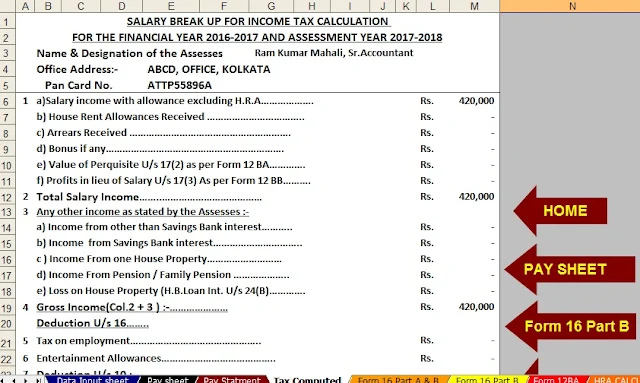

Download Automated TDS on Salary for Non-Govt employees for F.Y.20116-17 and A.Y.2017-18[ This Excel Based Software can prepare at a time Tax Computed Sheet + Individual Salary Structure as per Non-Govt employees Salary Pattern + Automatic H.R.A. Calculation U/s 10(13A) + Automatic Form 16 Part A&B and Form 16 Part B + Form 12 BA as per the Finance Budget 2016-17]

Section 80c

The maximum tax exemption limit under Section 80C has been

retained as Rs 1.5 Lakh only. The various investment avenues or expenses that

can be claimed as tax deductions under section 80c are as below;

- PPF (Public Provident Fund)

- EPF (Employees’ Provident Fund)

- Five year Bank or

Post office Tax saving Deposits

- NSC (National Savings

Certificates)

- ELSS Mutual

Funds (Equity Linked Saving Schemes)

- Kid’s Tuition Fees

- SCSS (Post office Senior Citizen

Savings Scheme)

- Principal repayment

of Home Loan

- NPS (National Pension System)

- Life Insurance

Premium

- Sukanya

Samriddhi Account Deposit Scheme

Section 80CCC

Contribution to annuity plan of LIC (Life Insurance Corporation of India

Section 80CCD

Employee can contribute to Government notified Pension

Schemes (like National

Pension Scheme – NPS). The contributions can be upto 10% of the salary

(or) Gross Income and Rs 50,000 additional tax benefit u/s 80CCD (1b) was

proposed in Budget 2015.

To claim this deduction, the employee has to contribute to

Govt recognized Pension schemes like NPS. The 10% of salary limit is applicable

for salaried individuals and Gross income is applicable for non-salaried. The

definition of Salary is only ‘Dearness Allowance.’ If your employer also

contributes to Pension Scheme, the whole contribution amount (10% of salary)can be

claimed as tax deduction under Section 80CCD (2).

Kindly note that the Total

Deduction under section

80C, 80CCC and 80CCD(1) together cannot exceed Rs 1,50,000 for the financial year 2016-17.

The additional tax deduction of Rs 50,000 u/s 80CCD (1b) & U/s 80CCD(2) is over and above this

Rs 1.5 Lakh limit.

Section 80D

Deduction u/s 80D on health insurance premium is Rs

25,000. For Senior Citizens it is Rs 30,000. For very senior citizen above the

age of 80 years who are not eligible to take health insurance, deduction is

allowed for Rs 30,000 toward medical expenditure.

Preventive health checkup (Medical

checkups) expenses to the

extent of Rs 5,000/- per family can be claimed as tax deductions. Remember,

this is not over and above the individual limits as explained above. (Family includes: Self, spouse,

dependent children and parents).

Section 80DD

You can claim up to Rs 75,000 for spending on medical

treatments of your dependents(spouse, parents, kids or siblings) who have 40% disability. The tax

deduction limit of upto Rs 1.25 lakh in case of severe disability can be

availed.

To claim this deduction, you have to submit Form no 10-IA.

Section 80DDB

An individual (less

than 60 years of age) can

claim up to Rs 40,000 for the treatment of specified critical ailments. This

can also be claimed on behalf of the dependents.

The tax deduction limit under this section for Senior Citizens is Rs 60,000 and

for very Senior Citizens(above 80 years) the limit is Rs 80,000.

To claim Tax deductions under Section 80DDB, it is mandatory

for an individual to obtain ‘Doctor Certificate’ or ‘Prescription’ from a

specialist working in a Govt or Private hospital.

For the purposes of section 80DDB, the following shall be the

eligible diseases or ailments:

- Neurological

Diseases where the disability level has been certified to be of 40% and

above;

(a) Dementia

(b) Dystonia Musculorum Deformans

(c) Motor Neuron Disease

(d) Ataxia

(e) Chorea

(f) Hemiballismus

(g) Aphasia

(h) Parkinson’s Disease

- Malignant

Cancers

- Full

Blown Acquired Immuno-Deficiency Syndrome (AIDS) ;

- Chronic

Renal failure

- Hematological

disorders

- Hemophilia

- Thalassaemia

Section 24 (B)

The interest component of home loans is allowed as deduction

under Section 24B for up to Rs 2 lakh in case of a self-occupied house.

If your property is a let-out one then the entire interest amount can be

claimed as tax deduction. (Read: Understanding Tax

Implications of Income from house property)

Section 80EE

This is a new proposal which has been made in

Budget 2016-17. First time Home Buyers can claim an additional Tax

deduction of up to Rs 50,000 on home loan interest payments u/s 80EE. The below

criteria has to be met for claiming tax deduction under section 80EE.

- The home

loan should have been sanctioned in FY 2016-17.

- Loan

amount should be less than Rs 35 Lakh.

- The

value of the house should not be more than Rs 50 Lakh &

- The home

buyer should not have any other existing residential house in his name.

Section 80U

This is similar to Section 80DD. Tax deduction is

allowed for the tax assessee who is physically and mentally challenged.

Section 80GG

As per the budget 2016 proposal, the Tax Deduction amount

under 80GG has been increased from Rs 24,000 per annum to Rs 60,000

per annum. Section 80GG is applicable for all those individuals who do not own

a residential house & do not receive HRA (House Rent Allowance).

The extent of tax deduction will be limited to

the least amount of the following;

- Rent

paid minus 10 percent the adjusted total income.

- Rs 5,000

per month.

- 25 % of

the total income.

Section 80G

Contributions made to certain relief funds and

charitable institutions can be claimed as a deduction under Section 80G of the

Income Tax Act. This deduction can only be claimed when the contribution has

been made via cheque or draft or in cash. But deduction is not allowed for

donations made in cash exceeding Rs 10,000. In-kind contributions such as food

material, clothes, medicines etc do not qualify for deduction under section

80G.

Section 80E

If you take any loan for higher studies (after completing Senior Secondary

Exam), tax deduction can be claimed under Section 80E for interest that

you pay towards your Education Loan. This loan should have been taken for

higher education for you, your spouse or your children or for a student for

whom you are a legal guardian. Principal Repayment on educational loan cannot

be claimed as tax deduction.

There is no limit on the amount of interest you

can claim as deduction under section 80E. The deduction is available for a

maximum of 8 years or till the interest is paid, whichever is earlier.

Section 87A Rebate

If you are earning below Rs 5 lakh, you can save an

additional Rs 3,000 in taxes. Tax rebate under Section 87A has been raised from

Rs 2,000 to Rs 5,000 for FY 2016-17 (AY

2017-18).

In case if your tax liability is less than Rs 5,000 for FY

2016-17, the rebate u/s 87A will be restricted up to income tax liability only.

Section 80 TTA

Deduction from gross total income of an individual or HUF, up

to a maximum of Rs. 10,000/-, in respect of interest on deposits in savings

account with a bank, co-operative society or post office can be claimed under

this section. Section 80TTA deduction is not available on interest income from fixed deposits.