The e-Filing the form is presented online. You fill the form and keep saving the draft. After the completion of the form, you have to submit it online. In this method, you do not download anything. It is an easier process, therefore, It is listed as Quick e-File. But, to use this facility you should have the reliable internet connection

Showing you the steps of the e-Filing process with complete illustration. The step by step guide with images would be very useful for the new taxpayer.

Steps To e-Filing

Login at www.Incometaxindiaefiling.gov.in portal. The PAN is used as user ID. You must remember the password. Otherwise, you should use forget password facility to reset the password. You need to give the date of birth in MM/DD/YYYY format for login.

After the login into the dashboard, click at Quick e-File in the left sidebar. It is the first option.

· Choose ITR form name. For salaried it should be ITR-1.

· The assessment your should be 2015-16. Please take care while selecting the assessment year. The assessment year 2015-16 is chosen for the income of the financial year 2014-15.

· Select an option for the address.

· If you have a digital signature, you can choose ‘yes’ on the next item. Most of us don’t have a digital signature, therefore it should remain ‘No’.

In the next page, you will see the instruction. Read them carefully. You can also download detailed instruction if required. However, I am trying to guide you.

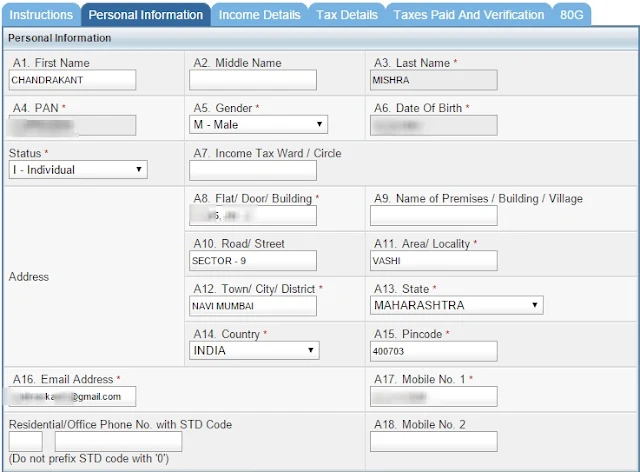

In the personal information tab, you may see your name, address, pan, date of birth, email, and mobile number. You can edit this information if there is any change. You can also give two mobile numbers.

· In the filing status section, at column ‘A19’ you have to choose the employer category. For private employee’s it would be others.

· Go through the column A20-A22. Most of you don't need to change the default.

- You have to select an option in column 23. For 99% people, it would be ‘No’

- Wait! You must go up to the last column this year. The A27 and A28 give you the option to provide the Adhaar number. Adhaar number will make the e-Filing process easier.

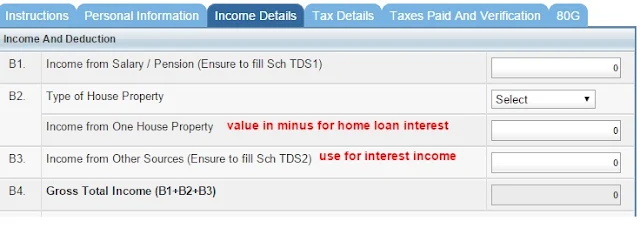

In the ‘Income Details’ tab you need to use the form 16. Go through the instruction of every column.

B1- you have to fill the taxable income from the head salaries. Refer to column 6 of form 16.

B2- This column for that assess who has taken the home loan or earning rent from the house property. Choose the type of property accordingly. Note, if you have more than one property to mention, you must use the ITR form 2A.

Fill the income from house property. If you are earning rent, fill the 70% of earned amount in this column. If you are paying interest on home loan fill it in this column. In case of home loan you must write the amount in negative (e. g. -85000) otherwise, your tax will increase instead of decreasing.

B3- This column is for the other income. This other income can be interest on bank deposit, interest waiver on company loan, ex gratia amount etc.

In the next section, you have to give details of investment and expense which are eligible for tax deductions.

C1 – In this column you have to fill the total amount eligible for tax deduction under section 80C. You can refer it from the form 16. However, If you could not tell some 80C investment to your employer, you can add it here. You should keep the proof with yourself.

C2-C18 – I have given the instruction of these columns in the screenshot. Please see the image. These columns are for various income tax exemptions.

In the tax computation section, except column D7 all the columns would be prefilled. The column D7 is the provision of tax relief under section 89 . Section 89 gives you some tax relief if your total taxable income also includes arrears.

Schedule TDS-1

In this section, you have to mention the taxes paid. You may find this section prefilled, as income tax department has data on your taxes paid against the salary. You should verify it with the form 16. The taxes paid information is mentioned in the beginning of form 16. Schedule TDS -2

In this section, you have to fill the tax paid details of other income. However, It should be pre-filled from the record of income tax department. You should have form 16A to verify the values in this column. If you don’t have any other income, leave this section blank.

Schedule IT

This section is to include the self-assessment tax or advance tax paid by you. You may have some earning without the TDS. You should pay income tax on such earning. In my case you can see there is a mention of Rs 51 tax paid. I have paid this tax to show the procedure of income tax e-payment. This section may be also pre-filled, you need to verify only. It is editable, you can fill your values if required.

The taxes paid and verification tab shows the total tax calculation. In this tab, you will see the payable tax by you according to the given information in the form. You will also see the value of total taxes paid. The difference between taxes paid and tax payable should be zero. If not, you may get the refund or pay the remaining income tax.

Schedule TDS -2

In this section, you have to fill the tax paid details of other income. However, It should be pre-filled from the record of income tax department. You should have form 16A to verify the values in this column. If you don’t have any other income, leave this section blank.

Schedule IT

This section is to include the self-assessment tax or advance tax paid by you. You may have some earning without the TDS. You should pay income tax on such earning. In my case you can see there is a mention of Rs 51 tax paid. I have paid this tax to show the procedure of income tax e-payment. This section may be also pre-filled, you need to verify only. It is editable, you can fill your values if required.

The taxes paid and verification tab shows the total tax calculation. In this tab, you will see the payable tax by you according to the given information in the form. You will also see the value of total taxes paid. The difference between taxes paid and tax payable should be zero. If not, you may get the refund or pay the remaining income tax. D17– If you see any value in column 17, hold your income tax return submission process. Now you need to check all values once again. If there is still some tax payable, you need to pay the required tax. You can pay income tax online within 10 minutes. After the payment of remaining income tax, you need to mention it in the Sch IT. You can add rows to enter the BSR code, challan number and amount of recently paid tax.

After the mention of taxes paid, there should be zero in column 17.

D18- If there is any refund, you will see the value in column D18. This refund process starts after you submit the income tax return form and income tax department verifies it. You can also check the status of income tax refund.

D19– In this column, you need to give the amount of exempted income. This income can be of dividend, gratuity, and PF proceeds. Please don’t ignore because it keeps away tax sleuths. Income tax department has an eye on your bank balance.

D17– If you see any value in column 17, hold your income tax return submission process. Now you need to check all values once again. If there is still some tax payable, you need to pay the required tax. You can pay income tax online within 10 minutes. After the payment of remaining income tax, you need to mention it in the Sch IT. You can add rows to enter the BSR code, challan number and amount of recently paid tax.

After the mention of taxes paid, there should be zero in column 17.

D18- If there is any refund, you will see the value in column D18. This refund process starts after you submit the income tax return form and income tax department verifies it. You can also check the status of income tax refund.

D19– In this column, you need to give the amount of exempted income. This income can be of dividend, gratuity, and PF proceeds. Please don’t ignore because it keeps away tax sleuths. Income tax department has an eye on your bank balance.

Bank Account Details

You are required to give bank account number to get income tax refund. Earlier it was not mandatory but, now you have to give one bank account number, whether you get the tax refund or not.

Besides this, you have to also give details of other active bank accounts. You can get IFSC code and bank account number from the cheque leaf. Verification

Verification