There are plenty of advantages for filing your income tax return, disadvantages being none. Whereas if you don’t file your return you will abstain from a lot of benefits, let alone the disadvantages.

Now let's check them out in detail:

ADVANTAGES OF FILING YOUR INCOME TAX RETURN:

- It becomes your standard income proof

- You can get the loans sanctioned quickly and easily

- You can trade in stocks, open bank accounts, get bank credits, make investments etc. and you can do all these with ease if you remain good in the financial institutions books by filing your tax returns.

- You can claim your refunds for taxes deducted or paid in excess of your tax liabilities.

- Many foreign countries want to know how financially sound you are before they grant you with a visa. So to prove your financial worth, Income tax returns are a must.

- Not to forget, it is your obligation. The taxes you pay on your income will work towards the betterment of our nation.

- For professionals and business organizations, Income tax returns are a must to become eligible to secure certain tenders.

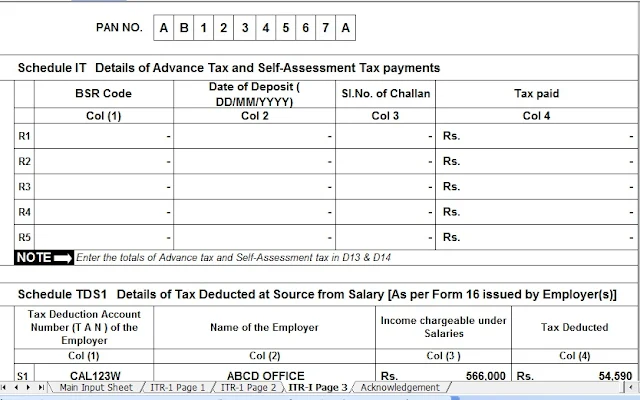

Download Automated Income Tax Return SAHAJ(ITR-I) For F.Y.2015-16 & A.Y.2016-17 [This Excel Based Software (Offline) can prepare automatic SAHAJ(ITR-I) for A.Y.2016-17 ]

DISADVANTAGES OF NOT FILING YOUR INCOME TAX RETURN:

- If you don’t file your return in time, you will have to pay interest on your tax dues when you file at a later date.

- If you have incurred losses, you can not carry forward the same to subsequent years if you do not file your return.

- You could become liable for a penalty or Prosecution by the Income Tax Department if you conceal or fail to disclose your income.