Most of us are aware of popular investment avenues, such as life insurance policies, Public Provident Fund (PPF), National Saving Certificates (NSC) etc., which are eligible for deduction under Section 80C of the Income-tax Act, 1961.

However, we tend to ignore a few other investments and expenditures that may also be eligible for tax concessions. It could save you a neat sum for a profitable investment. While making a tax-saving investment, evaluate the need and risk associated with each.

Here is some Item of some of the investments and expenditures that qualify for exemptions/ deductions under various sections of the Act.

Investments eligible under Section 80C/80CCC/80CCD

These investments are subject to a limit of Rs 1.5 lakh per financial year.

An additional deduction can be availed U/s 80CCD(2) for contribution to the pension fund by the employer, and Rs.50,000/- more deduction can be availed for New Pension Scheme U/s 80CCD(1B), out of the limit of 80C deduction 1.5 lakh.

Life insurance premiums: Deduction is available under Section 80C with respect to the premium paid towards life insurance policy for self, spouse, and any child. It may be noted that no deduction is available for any late-fee charges paid. The amount received on maturity of the policy is exempt from tax, subject to prescribed conditions.

While making the tax-saving investment, evaluate the risk associated with each product.

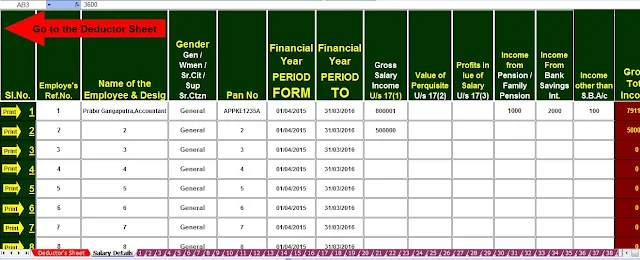

Download Automatic Master of Form 16 Part B for F.Y.2016-17 [ This Excel Based utility can prepare at a time 100 employees Form 16 Part B]

Public Provident Fund (PPF): Contribution to a PPF account in the name of self, spouse, and a child is eligible for deduction under Section 80C. Earlier the annual investment in PPF was limited to Rs 1,50,000, thereby limiting the tax deduction also.

National Saving Certificate (NSC): The amount invested in NSC is eligible for deduction under Section 80C. Further, the interest accrued annually on NSC, though taxable, is deemed to be re-invested and qualifies for deduction (except in the year of maturity).

Five-year bank fixed deposits (FDs): FDs with a scheduled bank, under a notified scheme, with a tenure of five years is eligible for deduction under the above section. However, the interest accrued on the FDs is subject to tax laws.

Post office five-year time deposit (POTD) scheme:POTDs are similar to bank FDs. A five-year POTD qualifies for deduction under Section 80C. However, interest accrued on the same is entirely taxable.

Senior Citizen Savings Scheme (SCSS): SCSS is another scheme eligible for deduction under Section 80C. However, it is intended only for senior citizens. The interest accrued on the same is entirely taxable.

Unit-linked insurance plans (Ulip): Investments in Ulips in the name of self, spouse and a child, which covers life with benefits of equity investments, is eligible for deduction under Section 80C.

Mutual fund (MF) and Equity-linked savings scheme (ELSS): Subscription to MFs and ELSSs qualifies for deduction under Section 80C. Currently, dividend and long-term capital gains on equity-oriented funds where securities transaction tax is paid are exempt from tax.

Home loan principal repayment: Equated monthly installments that are paid to repay home loans consists of two components-principal and interest. The principal component qualifies for deduction under Section 80C, provided the loan is taken from a prescribed lender (banks, PSU, etc.). The interest component can save your income tax as a deduction from rental income, subject to prescribed conditions.

Stamp duty and registration charges for a home: Stamp duty and registration charges paid for the transfer of property qualify for deduction under Section 80C.

Tuition fees: Tuition fees paid for full-time education in an Indian university, college, school, educational institution, for any two children are eligible for deduction under Section 80C. It is pertinent to note that tuition fees do not include payment towards any development fees or donation or payment of similar nature.

Other deductions

Medical insurance premium U/s 80D: Premium paid for self, spouse, and dependent children can be deducted up to Rs 25,000 per annum (pa) and an additional Rs 5,000 can be discounted if they are senior citizens. You can claim a deduction of up to Rs 30,000 for the premium paid for your parents' health cover, with an additional deduction of up to Rs 5,000 pa for senior citizens.

Maintenance, including treatment, of disabled dependent: Deduction of Rs 75,000 pa is available for expenditure incurred for treatment of a disabled dependent or for an amount deposited in a prescribed scheme (Section 80DD). The deduction is increased to Rs 1.5 lakh if the disability is severe over 80%.

Medical treatment: Deduction of up to Rs 40,000 (Rs 80,000 for senior citizens) is available under Section 80DDB per financial year on medical expenses incurred for treatment of specified diseases (self and dependent).

Donations: An amount donated to a prescribed charitable institution qualifies for deduction under Section 80G. It would need to be claimed at the time of filing your personal tax return.

Rent: This deduction is usually associated with salaried taxpayers. However, a deduction is also allowed for individuals who do not receive HRA under Section 80GG. The deductible amount is the rent paid in excess of 10% of total income subject to a maximum of Rs 5,000 per month or 25% of total income, whichever is less.

Interest on education loan: Interest paid on an education loan qualifies for deduction under Section 80E. It is available for eight years starting from the financial year in which the individual starts paying interest.