Every person wants to save tax. So, some of the people try to evade tax, which is wrong on behalf of a responsible citizen of a country. For saving tax the most common and best way is the use of section 80C of the income tax act,1962. Section 80C is the section which provides every individual some deductions from the taxable income which helps every individual to save tax. The maximum limit of section 80C is Rs.1,50,000. This much limit could help to save tax a lot as this may help some of the individual to get in lower slab rate.

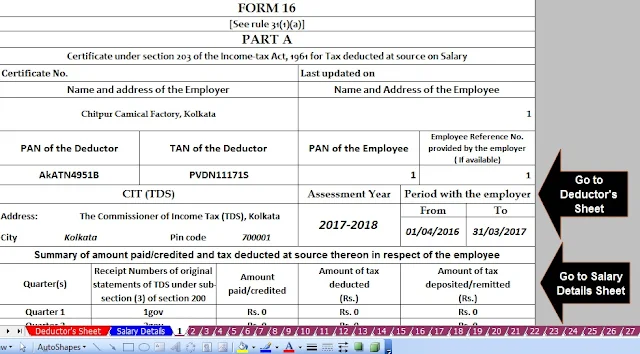

Download Automated Master of 50 employees Form 16 Part A&B and Form 16 Part B for Financial Year 2016-17 & Assessment Year 2017-18 [This Excel Utility can prepare at a time 50 employees Form 16 Part B for F.Y.2016-17]

People generally take this deduction by investing in some of the prescribed deposits or securities. But there are much more ways to reach the maximum limit other than by investment. Section 80C does not encourage only investment but also offers tax benefits in other expenses also.

Download Automatic 50 employees Master of Form 16 Part A&B for Financial Year 2016-17 & Assessment Year 2017-18 [ Who are not able to download the Form 16 Part A from the TRACES PORTAL, they can use this Automatic Form 16 Part A&B for F.Y.2016-17]

How to reach Rs.1,50,000 limit without investment?

School and College Tuition Fees

The deduction is allowed only for the full-time course in India. This deduction is only allowed for the maximum of 2 children. Payment made for part-time education, distance learning, private coaching and donations, late fees, transport charges are not allowed as deduction.

Repayment of Home Loans

Repayment of loan taken for Purchase and construction of residential property is allowed as deduction. The deduction is allowed only for principal amount. Repayment of loan taken for repair, maintenance, reconstruction is not allowed as deduction. The deduction is allowed only if such loan is taken from Central Government, bank, LIC or National Housing Bank. If the property is transferred before years then the deduction will not be allowed and the deduction allowed earlier is deemed to be income of that financial year.

Expenses paid as Stamp Duty and Registration Charges can be taken as the deduction.

Download Automated Arrears Relief Calculator with Form 10E up to F.Y.2016-17

Payment of life insurance premium are allowed as deduction:- Many of us take Life Insurance Policy as an investment. But if we consider LIC term plans, it can not be considered as investments plans.

The policy must be taken in the taxpayer’s name or spouse’s or any child’s name (whether married/ unmarried or dependent/ independent, minor/ major). HUF can take policy in the name of its members.

Provident fund contribution by employee

The provident fund contribution by employee accumulated over years could be the major constituent which itself could be more than Rs.1,50,000. 12% of basic pay + D.A. is deducted by the employer and deposited in Employee’s Provident Fund or Recognized Provident Fund.

Sum paid under non commutable deferred annuity for an individual on the life of taxpayer, spouse or child is allowed under this section.

After all these expenditures you may be left with no overall limit of 80C but if it is there it will be too less.

That you can fill up with investment. The investments under section 80C are:

· PPF

· NSC

· Post office Fixed deposit

· Senior Citizen Saving Scheme

· ELSS

· Fixed Deposit Account notified by Central Government

· Mutual Funds

· Bonds of NABARD

· Sukanya Samriddhi Account Scheme

· Unit-linked Insurance Plans (ULIP)

In this way, one can reach Rs.1,50,000 under 80C with no investment.