The Form 16 is now have two parts, Part A and Part B. The previous Format of Form 16 have already changed by the CBDT. In Part have the details of Tax Deposited into the Central Govt Account and Part B have all details of employees Salary. Now look below the Form 16 Part A

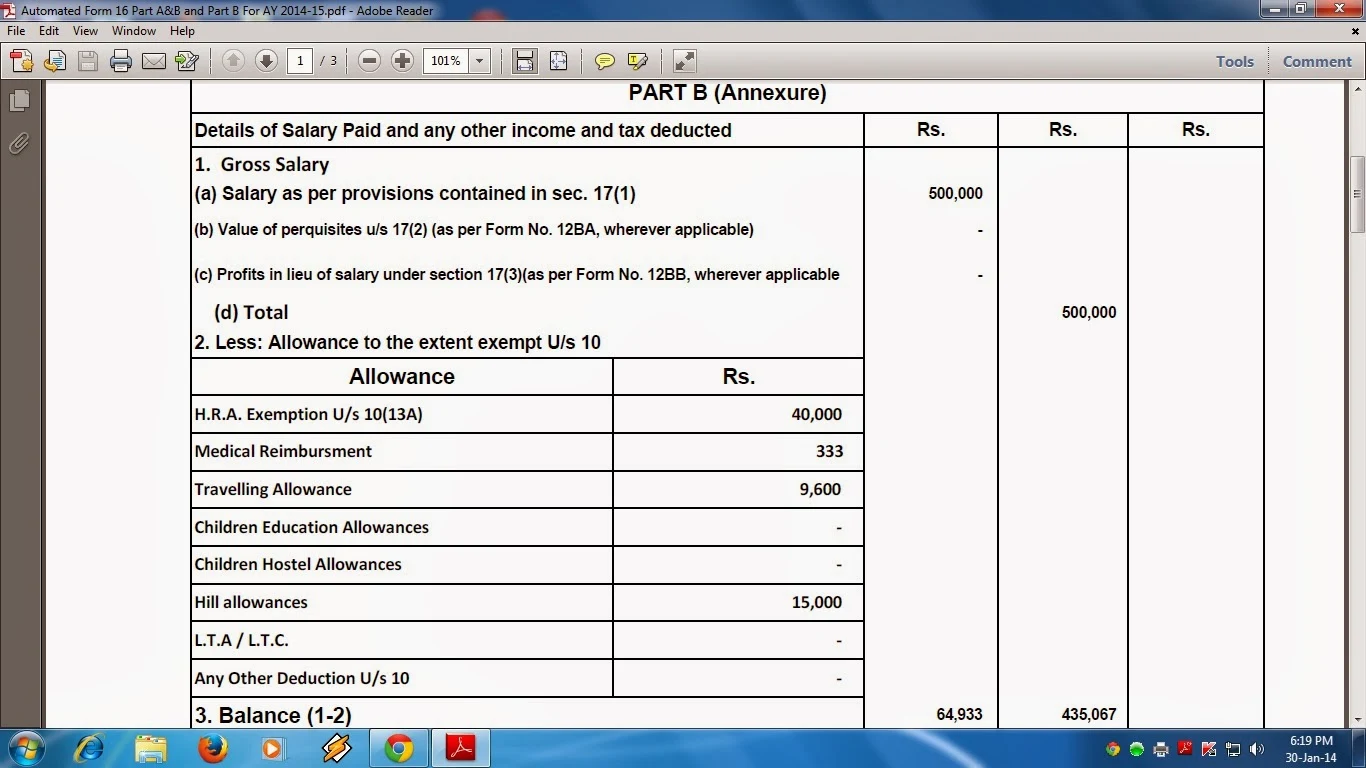

Now Look the Format of Form 16 Part B:-

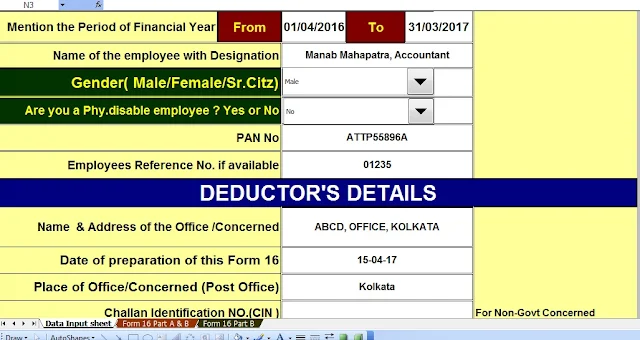

You can easily prepare One by One Form 16 Part A and Part A&B both for the Financial Year 2016-17 and Assessment Year 2017-18.

This Excel Based Software can prepare more than 100 employees Form 16 One by One.

Now Look the Format of Form 16 Part B:-

You can easily prepare One by One Form 16 Part A and Part A&B both for the Financial Year 2016-17 and Assessment Year 2017-18.

This Excel Based Software can prepare more than 100 employees Form 16 One by One.

As the CBDT has already notified that the Form 16 Part A must be download from the TRACES Portal and the Form 16 Part B must be prepared by the employer of Govt and Non-Govt Concerned.Most of the Concerned have not yet known about this new Notification which published on 19/2/2013. If you not able to download the Form 16 Part A from the TRACES Portal then you could not be given the Form 16 Part A, then you can use this utility which can prepare the Form 16 Part A and Part B both in One file.

OR if you have already downloaded the Form 16 Part A from the TRACES Portal, then you have to need the Form 16 Part B where the available of employee's Salary Details.

Here is given below the both of Excel Utility which can prepare Automated Form 16 Part B AND another one Can prepare Form 16 Part A and Part A&B for the Financial Year 2016-17.

Feature of this Utility:-

- Automatic Calculate the Income Tax Liability

- All the Income Tax Section have in this utility

- Prepare One by One Form 16 up to 100 employees Form 16

- Automatic Convert the Amount into the In Words

- No need to enable Macro as this Macro Free Excel Utility

- Easy to Generate and easy to install in any computer