In this fast moving world, young individuals switch job more often with an aim to get a better opportunity and better increment.

Form 16, is very vital for the salaried employee while filing tax returns.

However, a situation may arise when they have to file returns and are left with multiple Form 16. Here are 10 things you must know on Form 16.

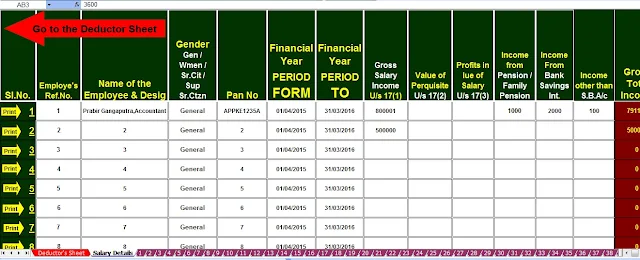

Download and prepare at a time 50 employees Automated Master of Form16 Part B for F.Y.2016-17 & A.Y.2017-18

Download and prepare at a time 100 employees Automated Master of Form16 Part B for F.Y.2016-17 & A.Y.2017-18

1) Form 16 is issued by the employer to employee. This certificate provides all details of salary earned and tax deducted at source by the employer.

2) If a person has changed job, he needs to collect the Form 16 from both the employer at the year end, with the help of both forms only he would able to file his returns.

3) An individual can have multiple Form 16 in cases such as a change in job or work with multiple employers simultaneously.

4) If your salary drawn is below the basic exemption limit, you may not be issued with this certificate by your employer as no TDS is deducted.

5) If your employer has not provided with Form 16, you can check the salary slip as it will mention the same.

6) Form 16 includes key information required such as gross salary, perquisites, various allowances, and deductibles.

7) If you have changed the job in the same financial year, authorities require you, to sum up, the total income from both the employers and file income tax return.

8) If the previous employer has not issued form 16 on account of some reason such as no tax deduction at its end, the employee can file the return taking into consideration the pay-slips plus the form 16 issued by the new employer.

9) If you do not wish to furnish form 16 issued by your previous employer to the new employer, you can file tax return taking cues from the two form 16 issued by the previous and new employer.

10) Form 16 will must mention the PAN Number of the employer.