Tax Treatment of Gratuity as per Income Tax

Act,1961 is covered U/S 10(10) of the Act. In case of retirement,

resignation or termination, you have to consider Income Tax liability on

propose receipt of Gratuity. If Gratuity is received by employee himself, it

will be taxable under head salary while if it is received by legal heir

on death of employee, It will be taxable under “Income from other sources’ to

the extent it is not chargeable to tax as per below mentioned provision

Tax Treatment of Gratuity depends on type of employee viz;

1. Government Employee

2. Employee cover under Gratuity Act

3. Any other Employee

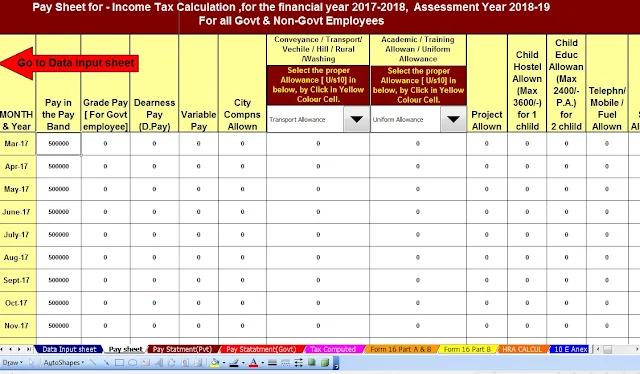

DownloadAll in One TDS on Salary for Govt & Non-Govt employees for F.Y.2017-18 [ This Excel Utility can prepare at a time Tax Computed Sheet + Individual Salary Structure as per Govt & Non-Govt Salary Pattern + Automated H.R.A. Calculation + Automated Arrears Relief Calculation with Form 10E U/s 89(1) + Automated Form 16 Part A & B and Form 16 Part B for A.Y.2018-19]

1. Government Employee: Any death cum

retirement gratuity received by employee of Central

Government, State Government or local authority ( Employee of statutory

corporation are not covered ) is wholly exempt from tax.

2. Employee cover under

Gratuity Act,1972 is exempt from tax to the extent of minimum of either

of below three items;

1. 15 day’s Salary ( 7 days

per season in case of employees of seasonal establishments )based on the

salary last drawn for every completed year of service or part thereof in excess

of 6 months

2. Rs. 10,00,000 ( Rs.

3,50,000 up to 23rd May,2010)

3. Actual Gratuity received

by employee

As per Gratuity Act,1972

, Gratuity shall be payable to an employee on termination of his employment

after he has rendered continuous service for not less than 5 years on his

retirement, resignation, superannuation, death, disablement due to accident or

disease. In case of death or disablement continuous service of 5 years is not

mandatory.

Employee can claim relief

under section 89 of Income Tax in case of taxable gratuity.

Meaning of Salary: For

computation of salary as per point 2(1) as mentioned above means salary

last drawn by the employee and includes dearness allowance but doesn’t include

any bonus, commission, house rent allowance, overtime wages or any other

allowance. 15 days salary can be calculated as under;

3. Any

another Employee: Any gratuity received by employee which is not

covered in above two points on termination, retirement, death,

resignation or on his becoming incapacitated prior to retirement, is exempt

from tax to the extent of minimum of either of below three items on due

or receipt basis;

1. Half month’s average

salary for each completed year of service. (Completed years include from

existing employer plus previous employer) e.g 10 years 11 months 10 days. Half

month’s average salary for 10 completed years can be considered.

2. Rs. 10,00,000 ( Rs.

3,50,000 up to 23rd May,2010)

3. Actual Gratuity received

by employee

Meaning of Average

Salary: For computation of salary as per point 3(1) as mentioned above

means salary of 10 months immediately preceding the month in which the

person retires. e.g. if employee retires on 3rd Jan,2013. An

average salary will be taken from 01.03.2012 to 31.12.2012.

Salary mean last drawn

salary by the employee and includes dearness allowance ( if terms of employment

so provide) but doesn’t include any bonus, commission, house rent allowance,

overtime wages or any other allowance. If terms of employments provide

commission for a fixed percentage of turnover achievement, same will be

included in salary.

If gratuity received by

employee from more than one employer in same financial year or different years,

agreement maximum amount of gratuity cannot exceed Rs. 10 Lacs as mentioned in

point 3(2) above.

Please note that gratuity

received during the employment do not qualify for exemption from tax. Assessee

can claim relief under section 89(1) of Income Tax Act.