Download Automated Govt & Non-Govt employees for F.Y.2017-18 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure + Automatic H.R.A. Exemption Calculation + Automated Arrears Relief Calculator with Form 10e From F.Y.2000-01 to F.Y.2017-18 + Automated Form 16 Part A&B and Form 16 Part B as per the new Income Tax Slab for F.Y.2017-18 ]

So as I said above this section only applies to

those who have not availed HRA in their salary or not claiming the deduction on

their rent in any of the other sections of income tax. Below are a few

conditions to avail the deduction under this section.

- This section is only applicable to Individual or HUF.

- Tax Payer may be either salaried or a self-employed. However, must not be getting HRA.

- Tax Payer himself or spouse/Minor Child/HUF of which he is a member should not own any accommodation at a place where he is doing a job or business.

- If Tax Payer owns house at a place other than the place noted above, then the concession in respect of self occupied property is not claimed by him [Under Section 23 (2) (a) or 23 (4) (a)].

- Tax Payer has to file a declaration in Form No.10BA regarding the expenditure incurred by him towards the payment of rent.

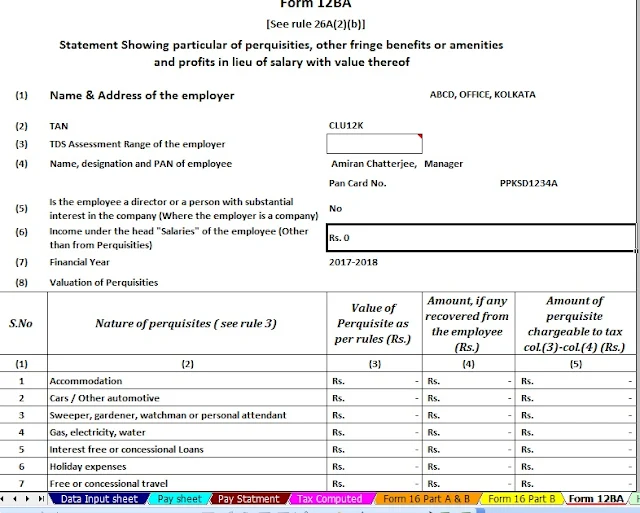

Download Automated All in One TDS on Salary for Non-Govt Employees for F.Y.2017-18 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt Concerned salary pattern + Automatic H.R.A. Calculation U/s 10(13A) + Automated Form 12 BA + Automated Form 16 Part A&B and Form 16 Part B for F.Y.2017-18 ]

If the above five conditions are satisfied, the

amount deductible under Section 80GG is LEAST OF THE FOLLOWING.

- Rs.5, 000 per month;

- 25% of total income of taxpayer for the year; or

- Rent Paid less 10% of total income (Rent Paid-10% of Total Income).

What is total income for the

purpose of Sec. 80GG?

We can calculate it as below.

Total Income=Gross Total Income-LTCG-STCG-Income

referred under the Sec.115A-Amount deductible under Sec.80C to 80U (except

Section 80GG)

Let us try with one example-

Mr. X’s total income (calculated as per above

formula) is Rs.4, 00,000. He pays an annual rent of Rs.1, 50,000. Then least of

the below will be applicable for deduction under Sec. 80GG.

- Rs.60, 000 per year.

- Rent Paid-10% of Total Income=Rs. 1,50,000-Rs.40,000=Rs.1,10,000.

- 25% of Total Income i.e Rs.1, 00,000.

So least of the above will be Rs.60, 000, which one

can claim under Section 80GG for that particular FY.