December 4, 2017

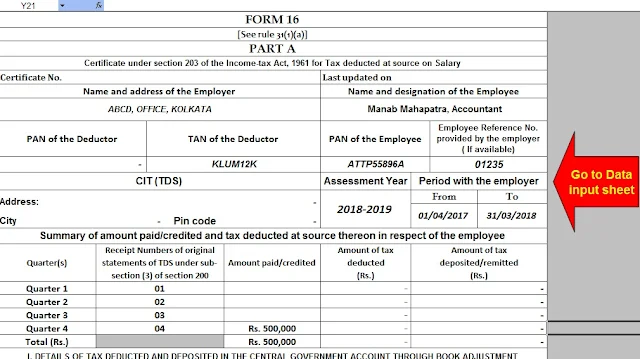

[ This Excel Utility can prepare at

a time Tax Compute Sheet + Salary Sheet + Salary Structure + HRA

Calculation + Arrears Relief Calculator + Form 10E +Form 16 Part

A&B + Part B as per new Income Tax Slab 2017-18]

Income Tax Rebate U/s 87A for F.Y. 2017-18

Tags:

Automated Income Tax Calculator for Govt and Non Govt Employees for the F.Y 2017-18,

Income Tax Rebate U/s 87A for F.Y. 2017-18