Section 80GG is one of the lesser-known sections which can be used by taxpayers to lessen their tax burden by claiming tax exemption for rent paid (Who do not get the H.R.A. from his employer). This section can be used by being either salaried/pensioner or self-employed taxpayers.

Conditions for Claiming Tax benefit u/s 80GG for Rent Paid

You can claim the tax deduction for rent paid u/s 80GG at the time of filing a tax return only if following conditions are satisfied:

1. The deduction is available only for individuals & HUFs

2. For the salaried person to be eligible for tax benefit u/s 80GG, he should not receive HRA from his employer.

3. Pensioners or Self-employed do not have any HRA and so they can take advantage of 80GG

4. No one in the family including spouse, minor children, self or HUF he is a member of should own a house in the city you are employed or carrying your business.

5. If you own a house in the different city, you cannot show it as self-occupied. You have to consider it as deemed to let out – i.e. – you have to show rental income whether or not it’s actually put on rent.

Additionally, you need to download & fill form No 10BA to claim tax benefit u/s 80GG.

|

| SNAPSHOT OF FORM 10BA |

This form is NOT to be submitted anywhere but kept with you for records to show to I-T department in case of scrutiny.

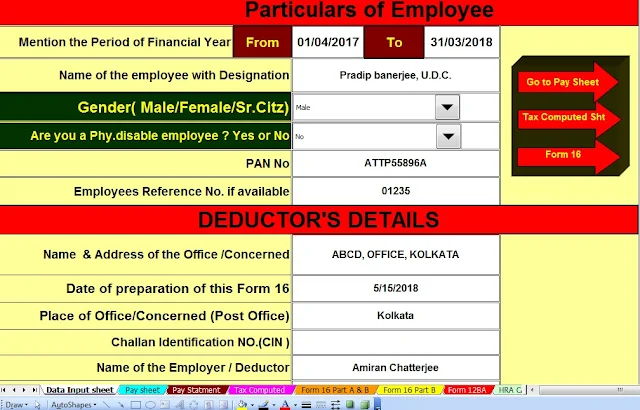

Download Automated All in One Income Tax Preparation Excel Based Software for Non-Govt Employees( Private Employees) for F.Y.2017-18 [ This Excel utility can prepare at a time Individual Salary Sheet + Individual Salary Structure as per Non-Govt Salary Pattern + Automatic H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 16 Part A&B and Form 16 Part B for F.Y.2017-18 ]

|

| Main Input Sheet for details of Employer & Employees |

|

| Individual Salary Structure for Non-Govt employees |

|

| Automated Tax Computed Sheet |

|

| Automated Form 12 BA |

|

| Automated Form 16 Part B |

The deduction allowed u/s 80GG:

The House Rent deduction is minimum of the below 3 numbers:

1. Rs. 5,000 per month [increased from Rs 2,000 to Rs 5,000 in Budget 2016]

2. 25% of annual income

3. (Rent Paid – 10% of Annual Income)

Here Annual income refers to

§ Gross Total Income

Minus

§ Long Term Capital Gain,

§ Short Term Capital Gain of 10% category,

§ Deductions under sections 80C to 80U except for section 80GG and income of foreign company

Assume that Amit has an annual income of Rs 5 Lakhs and he pays rent of Rs 10,000 per month. Here is his tax benefit for rent paid.

1. Rs. 5,000 per month – Rs 60,000

2. 25% of annual income – Rs 1,25,000

3. (Rent Paid – 10% of Annual Income) – Rs 70,000 (1,20,000 – 50,000)