If you have a dependent person in your

family who is suffering from a disability, then you can avail tax benefit under

section 80DD. This deduction is offered to help you take care of your

disabled family member who is dependent on you.

If the individual himself is suffering from a disability, then he can claim tax benefits under section 80U.

If the individual himself is suffering from a disability, then he can claim tax benefits under section 80U.

Eligibility for deduction under section 80DD

Any individual or HUF (Hindu Undivided

Family) who is a Resident of India is eligible to claim this deduction.

This tax deduction is not available to NRIs (Non-Resident Individual).

This tax deduction is not available to NRIs (Non-Resident Individual).

Who is a disabled dependent under section 80DD?

- For individuals, a disabled dependent can be spouse, son / daughter (any child), parents, brother / sister (siblings).

- For HUFs, a disabled dependent can be any member of the HUF.

The disabled person should be dependent on the

person claiming deduction. The disabled person should not have claimed

deduction under section 80U.

What expenses are eligible for deduction under section 80DD?

- Any expenditure made towards medical treatment, nursing, training, rehabilitation of a dependent person with disability.

- Any amount paid as premium for a specific insurance policy designed for such cases. The policy must satisfy the conditions mentioned in the law.

- If the disabled dependent predeceases the person claiming deduction under this section, then an amount equal to the amount of premium paid shall be considered to be the income of the claimer for previous year (i.e., the year in which such amount is received by the claimer / assessee) and shall be chargeable to tax.

Deduction amount

Deduction allowed varies depending on whether the

dependent person has disability or severe disability.

A) Dependent person with disability

If the dependent person has at least 40% of

any of the specified disability, then he is considered a person with

disability.

Hence, the individual taking care of the medical expenses of dependent person with disability can get tax deduction of Rs. 75,000.

Hence, the individual taking care of the medical expenses of dependent person with disability can get tax deduction of Rs. 75,000.

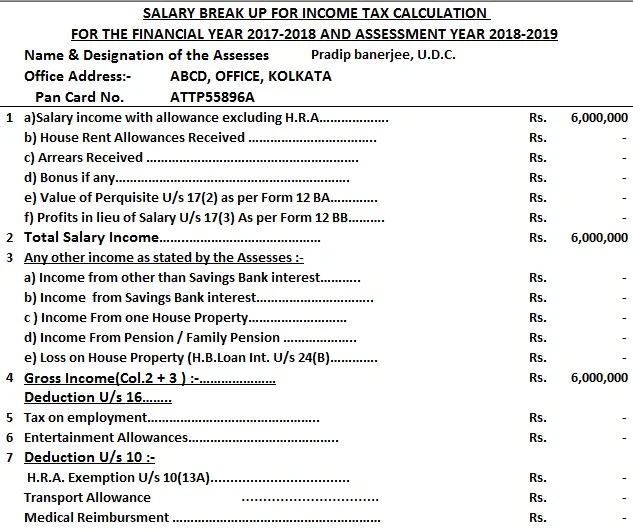

Click here to Download Automated Income Tax All in One TDS on Salary for Govt &Non – Govt Employees for F.Y.2017-18 & Ass Year 2018-19 with New Tax Slab as per Finance Budget 2017-18

The Main Feature of this Excel Utility :-

1) Automatic Calculate your Income Tax as per new

Tax Slab for F.Y.2017-18

2) All Amended Income Tax Section have in this

Excel Utility as per Budget 2017-18

3) Automatic Calculate House Rent Exemption

Calculation U/s 10(13A)

4) Individual Salary Structure for both of Govt

& Non-Govt Concerned Salary Pattern

5) Automated Calculate the Arrears Relief with Form

10E up to F.Y.2017-18

6) Automated Income Tax Form 16 Part B for

F.Y.2017-18

7) Automated Income Tax Form 16 Part A&B for

F.Y.2017-18

8) Easy to install in any computer and easy to

generate just like as an Excel File

9) Automatic Convert the Amount in to the In –

Words without any Excel Formula.

B) Dependent person with severe disability

If the dependent person has at least 80% of

any disability, then he is considered a person with severe disability.

Hence, the individual taking care of the medical expenses of dependent person with severe disability can get tax deduction of Rs. 1,25,000.

Hence, the individual taking care of the medical expenses of dependent person with severe disability can get tax deduction of Rs. 1,25,000.

Table Showing Tax Deduction under

section 80DD

|

|

Type

|

Amount (in Rupees)

|

Dependent person with disability

|

Rs. 75,000

|

Dependent person with severe disability

|

Rs. 1,25,000

|

Disabilities covered under section 80DD

- Blindness

- Low vision

- Leprosy-cured

- Loco motor disability

- Hearing impairment

- Mental retardation

- Mental illness

- Autism

- Cerebral palsy

Who can certify a person as a disabled person?

- A Civil Surgeon or Chief Medical Officer (CMO) of a government hospital

- A Neurologist with an MD in Neurology

- In case of children, a Paediatric Neurologist having an equivalent degree

Documents Required to Claim Deduction under section 80DD?

The section 80DD deals with providing tax

deductions to individuals and/or HUFs for caring for a disabled dependent. You

will require the following documents to claim tax benefits of section 80DD.

Medical Certificate:

You will be required to produce / submit a medical

certificate authenticating the disability of your dependent from a certified medical authority as defined by the law.

Form 10-IA:

In case your disabled dependant is suffering from

Autism, Cerebral Palsy or multiple disabilities, you will need to produce form

number 10-IA.

Click here to download Form 10-IA in word formatClick here to download Form 10-IA in pdf format

Self-declaration certificate:

You also need to furnish a self-declaration

certificate stating the expenses incurred by you on your handicapped dependent

for his medical treatment (including nursing), training and rehabilitation.

Receipts of Insurance Premium Paid:

Since self-declaration certificate is enough for

claiming most expenses, you do not need to keep actual receipts of those

expenses. However, if you want to claim any deduction payment towards any

insurance policies taken for a disabled dependent, then you need actual

receipts of expenses.