Income Tax 2017-18 (Assessment Year 2018-19) – Income Tax Structure, Exemption and Deductions available to Personal Income Tax Payers

PART I: Income Tax Slab for Individual Tax Payers & HUF (Other than Senior Citizens)

Income Slab Tax Rate

| ||

Income up to Rs 2,50,000* No tax

| ||

Income from Rs 2,50,000 – Rs 5,00,000 5%

| ||

Income from Rs 5,00,000 – 10,00,000 20%

| ||

Income more than Rs 10,00,000 30%

| ||

Surcharge: 10% of income tax, where total income

exceeds Rs.50 lakh up to Rs.1 crore.

Surcharge: 15% of income tax, where the total income exceeds Rs.1

crore. |

||

Cess: 3% on total of income tax + surcharge.

|

||

*Income tax exemption limit for FY 2017-18 is up to Rs.

2,50,000 for individual & HUF other than those covered in Part(II) or

(III)

|

||

|

|

||

PART II: Income Tax Slab for Senior Citizens (60 Years Old Or More but Less than 80 Years Old)(Both Men & Women)

Income Slab Tax Rate

| ||

Income up to Rs 3,00,000* No tax

| ||

Income from Rs 3,00,000 – Rs 5,00,000 5%

| ||

Income from Rs 5,00,000 – 10,00,000 20%

| ||

Income more than Rs 10,00,000 30%

| ||

Surcharge: 10% of income tax, where total income

exceeds Rs.50 lakh up to Rs.1 crore.

Surcharge: 15% of income tax, where the total income exceeds Rs.1

crore. |

||

Cess: 3% on total of income tax + surcharge.

|

||

*Income tax exemption limit for FY 2017-1 is up to Rs.

3,00,000 other than those covered in Part(I) or (III)

|

||

|

|

||

PART III: Income Tax Slab for Senior Citizens(80 Years Old Or More) (Both Men & Women)

Income Slab

|

Tax Rate

|

|

Income up to Rs 2,50,000*

|

No tax

|

|

Income up to Rs 5,00,000*

|

No tax

|

|

Income from Rs 5,00,000 – 10,00,000

|

20%

|

|

Income more than Rs 10,00,000

|

30%

|

|

Surcharge: 15% of income tax, where total income

exceeds Rs.1 crore.

|

||

Cess: 3% on total of income tax + surcharge.

|

||

*Income tax exemption limit for FY 2017-18 is up to Rs.

5,00,000 other than those covered in Part(I) or (II)

|

||

Deductions available under Chapter VI A (Section 80)

Section

|

Deduction on

|

FY 2017-18

|

Section 80C

|

|

Rs. 1,50,000

|

80CC

|

For amount deposited in annuity plan of LIC or any other

insurer for pension from a fund referred to in Section 10(23AAB).

|

–

|

80CCD(1)

|

Employee’s contribution to NPS account (maximum up to Rs

1,50,000)

|

–

|

80CCD(2)

|

Employer’s contribution to NPS account

|

Maximum up to 10% of salary

|

80CCD(1B)

|

Additional contribution to NPS

|

Rs. 50,000

|

80TTA

|

Interest Income from Savings account

|

Maximum up to 10,000

|

80GG

|

For rent paid when HRA is not received from employer

|

Least of rent paid minus 10% of total income Rs. 5000/-

per month 25% of total income

|

80E

|

Interest on education loan

|

Interest paid for a period of 8 years

|

80EE

|

Interest on home loan for first time home owners

|

Rs 50,000

|

80D

|

Medical Insurance – Self, spouse, children

Medical Insurance – Parents more than 60 years old or (from FY 2015-16) uninsured parents more than 80 years old |

Rs. 25,000

Rs. 30,000 |

80DD

|

Medical treatment for handicapped dependant or payment to

specified scheme for maintenance of handicapped dependant

|

·

|

80DDB

|

Medical Expenditure on Self or Dependent Relative for

diseases specified in Rule 11DD

|

|

80U

|

Self suffering from disability:

|

·

|

Income or loss on House Property – Section 24 of Income Tax Act 2017 (Income Tax Exemption on interest paid on Housing Loan)

Consequent upon enactment of

Finance Act 2017, the maximum limit of interest paid house property has been

capped at Rs.2 lakh, whether or not the house is self occupied or rented out.

Earlier if the house property is Rented out, there was no maximum limit in

deducting interest paid on housing loan from the income of the tax payer.

List of Exempted Income under Section 10 of Income Tax Act (Subject to certain conditions

List of Exempted Income under Section 10 of Income Tax Act (Subject to certain conditions

- Agriculture Income [Section 10(1)]

- Perquisites and Allowances paid by Government to its Employees serving outside India [Section 10(7)]

- Gratuity [Section 10(10)]

- Commuted value of pension received [Section 10(I0A)]

- Amount received as leave encasement on retirement [Section 10(10AA)]

- Retrenchment compensation paid to workmen [Section 10(10B)]

- Retirement Compensation from a Public Sector Company or any other Company [Section 10 (10C)]

- Income by way of tax on perks [Section 10(10CC)]

- Any sum received under a life insurance policy [Section 10(10D)]

- Payment from Statutory Provident Fund [Section 10(11)]

- Payment from Recognised Fund [Section 10(12)]

- Payment from Superannuation Fund [Section 10(13)]

- House Rent Allowance [Section 10(13A) Read with Rule 2A]

- Scholarship [Section 10(16)]

- Pension received by certain winners of gallantry awards [Section 10(18)]

- Family pension received by family members of armed forces including para military forces [Section 10(19)]

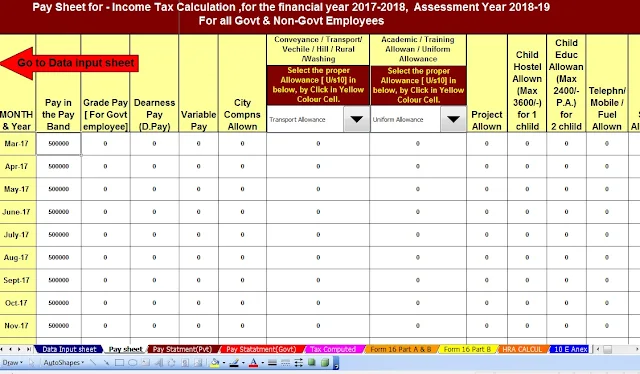

Download Automated All in One TDS on Salary for Govt & Non-Govt employees for F.Y.2017-18 with new Tax Slab

Feature of this Excel Utility :-

1) Automatic Calculation Income

Tax as per new Tax Slab for F.Y.2017-18

2) Automated H.R.A. Calculation

U/s 89(1) with Form 10E

3) Automated Arrears Relief

Calculator with Form 10E up to F.Y.2017-18

4) Individual Salary Structure

for both of Govt & Non-Govt employees Salary Pattern

5) Automated Individual Salary

Sheet

6) Automated Form 16 Part A&B

for F.Y.2017-18