In the Union Budget 2017, the rebate provided u/s 87A has been reduced to Rs.2500 on income up to Rs.350000, for the financial year 2017-18.

Rebate u/s 87A will be allowed as per the following schedule for different financial years:

Financial Year Amount of Rebate Income Upto

2016-17 5000 500000

2017-18 2500 350000

The rebate u/s 87A shall be available if you satisfy the following two conditions.

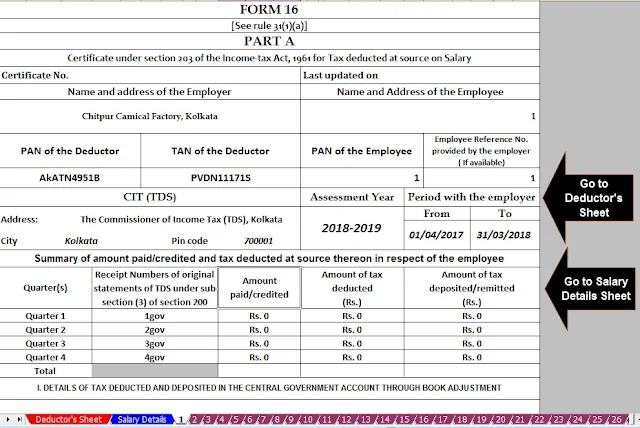

Click here to Download Automated Form 16 Part A&B and Part B for F.Y.2017-18 & A.Y.2018-19 [ This Excel utility can prepare (One by One) Automatic Form 16 Part A&B and Part B for F.Y.2017-18]

· You are the Resident individual.

· Your total income (after deduction u/s 80C -80U and house property loss if any) is equal to or less than Rs.350000 (Rs.500000 for FY 2016-17)

If both the above conditions are satisfied, a rebate of Rs.2500 (Rs.5000 for FY 2016-17) or actual tax payable whichever is less, is allowed. This rebate is allowed on total tax before education cess. This rebate is also allowed to Senior Citizens but not allowed to Super Senior Citizens as their income is already exempted up to Rs.500000.

1 total income of Rs.350000 means the sum total of the income from all the heads of income. It includes Income From Salary, Income From House Property, Income from Business oorProfession, Income Form Capital Gains and Income From Other Source

2 Total Income of Rs.350000 should be taken after allowing all the deductions u/s 80C to 80U of income tax act.

3 If there is any loss under the head, Income From House Property, due to the payment of interest on house loan or any other reason, such loss should also be deducted from total income and the resultant figure should be equal to or less than Rs.350000.

4 A person should be resident individual to claim rebate u/s 87A. For non-resident, this rebate is not allowed.

5 Rebate u/s 87A is allowed before levying of education cess and secondary and higher education cess.

6 The total rebate allowed u/s 87A is Rs.2500 or actual tax payable whichever is less.

7. The Rebate u/s 87A is also allowed to Senior Citizens but it is not allowed.