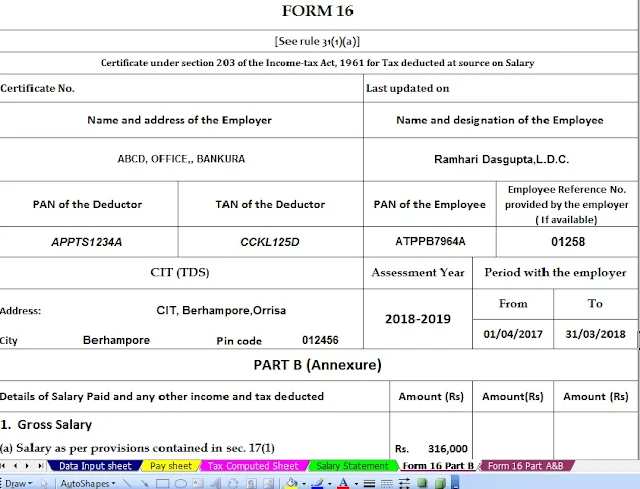

For the person earning income from Salary ,

documents Form 16, and Form 12BA are

provided by an employer which has details about his salary, perquisites and tax

deducted at source(TDS) by his employer.Looked into details of Form 16. Form 12BA give details of Perquisites given by the employer to the

employee had looked into what are perquisites, what income tax laws apply to

it, about the valuation of perquisites and the taxation with an example,

which perquisites are exempted from tax, Difference between

Perquisite, Allowance, and Fringe benefit. In this article, we shall see

how Form 12BA shows the information about

perquisites.

Form 12BA

Form 12BA is

a statement showing particulars of perquisites, other fringe benefits or

amenities, and profits in lieu of salary with value thereof.

Form No. 12BA, if the amount of

salary paid or payable to the employee is more than one lakh and fifty thousand

rupees, which shall accompany the return of income of the employee.

[Explanation : “Salary” for the purposes of this rule shall have the same

meaning as given in rule 3.]

Note:The limit has

changed to one lakh and eight thousand (1,80,000) by circular in 2011.