Individuals who are residing in India

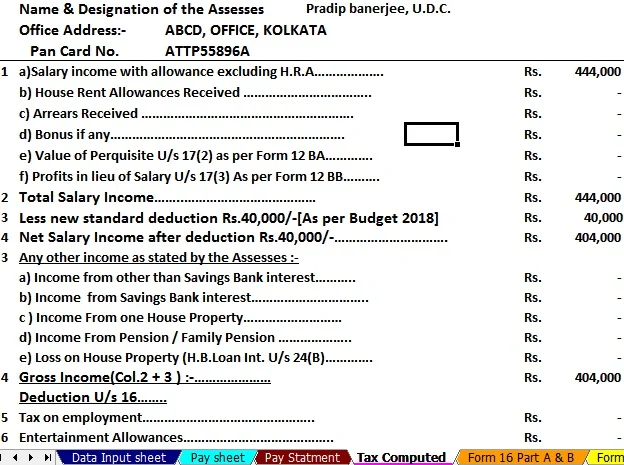

Download Automated Income Tax All in One TDS on Salary for Only Non-Govt ( Private ) Employees for the Financial Year 2018-19 [ This Excel Utility can prepare at a time your Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure as per Non-Govt (Private) Concerned Salary Pattern + Automatic Calculate the H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 12 BA + Automated Income Tax Form 16 Part A&B and Form 16 Part B as per the Finance Budget 2018-19 ]

Who will get the rebate under section 87a for A.Y.2019-20

The employee who is an individual resident and who gets the salary (After less the all deductions) which does not exceed 3,50,000 in the financial year then they will get the 2500/- rebate u/s 87a income tax act. Senior citizens (Age 60 ≥ 80 ) also eligible for rebate 2500/- u/s 87a.This rebate will be added before calculation of education & Health cess @ 4% on tax

Examples :

1.Individual and Resident of India

Total Taxable Income

|

Tax

|

Rebate u/s 87a

|

Tax Payable

|

Cess @ 4%

|

Net Tax Payable

|

300000

|

2500

|

2500

|

0

|

0

|

0

|

350000

|

5000

|

2500

|

2500

|

100

|

2600

|

400000

|

7500

|

0

|

7500

|

300

|

7800

|

500000

|

12500

|

0

|

12500

|

500

|

13000

|

2. Individual and Resident of India

Total Taxable Income

|

Tax

|

Rebate u/s 87a

|

Tax Payable

|

Cess @ 4%

|

Net Tax Payable

|

300000

|

0

|

0

|

0

|

0

|

0

|

350000

|

2500

|

2500

|

0

|

0

|

0

|

400000

|

5000

|

0

|

5000

|

200

|

5200

|

500000

|

10000

|

0

|

10000

|

400

|

10200

|

1.Individual and Resident of India

Total Taxable Income

|

Tax

|

Rebate u/s 87a

|

Tax Payable

|

Cess @ 4%

|

Net Tax Payable

|

300000

|

2500

|

2500

|

0

|

0

|

0

|

350000

|

5000

|

2500

|

2500

|

75

|

2575

|

400000

|

7500

|

0

|

7500

|

225

|

7725

|

500000

|

10000

|

0

|

12500

|

375

|

12875

|

2. Individual and Resident of India

Total Taxable Income

|

Tax

|

Rebate u/s 87a

|

Tax Payable

|

Cess @ 4%

|

Net Tax Payable

|

300000

|

0

|

0

|

0

|

0

|

0

|

350000

|

2500

|

2500

|

0

|

0

|

0

|

400000

|

5000

|

0

|

5000

|

150

|

5150

|

500000

|

10000

|

0

|

10000

|

300

|

10300

|