Budget 2018 in conjunction with several changes to tax laws conjointly introduced a brand new Section 80TTB. in line with this grownup will claim tax exemption up to Rs 50,000 on interest financial gain from bank/ post workplace fastened deposit, continual deposit or bank account. Also, if a grownup opts to require advantage of Section 80TTB, he cannot claim more deduction u/s 80TTA. Non-senior voters and HUFs don't seem to be eligible for 80TTB exemption. but Non-senior voters will still avail the deduction offered underneath section 80TTA, wherever interest financial gain up to Rs 10,000 from a bank account is tax exempted.

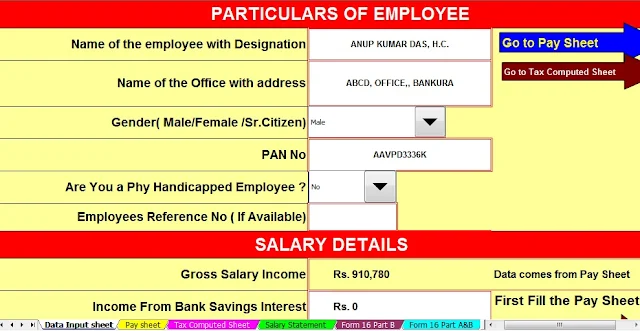

Download Automated Income Tax Form 16 Part B for F.Y.2018-19 [ This Excel Utility can prepare Form 16 Part B One by One for F.Y. 2018-19 ]

So, going forward from FY 2018-19 (AY 2019-20) there's No amendment for individuals below the age of sixty whereas for Senior voters they get further tax exemption for the interest financial gain. in addition just in case of Senior voters the edge for TDS (Tax Deduction at Source) on interest financial gain has been raised from Rs10,000 to Rs 50.000 from FY 2018-19. just in case your financial gain is a smaller amount than the tax threshold you'll avoid TDS by filling and submitting type 15H to relevant banks and monetary establishments.

Download Automated Income Tax Form 16 Part A&B and Part B for the Financial Year 2018-19 [ This Excel Utility can prepare One by One Form 16 Part A&B and Part B for F.Y.2018-19 ]

Section 80TTB Vs 80TTA:

As 80TTB is newly introduced section, some individuals would possibly confuse with 80TTA, thus there may be an outline of the distinction between 2 sections.

Section 80TTA & Section 80TTB

Eligibility Available for all taxpayers. However, if Senior voters prefer 80TTB, {they willnot|they can't|they can not} take 80TTA advantage Only Senior voters can avail

Tax Exemption Up to Rs 10,000 exemption Up to Rs 50,000 exemption

Eligible Income Only interest financial gain in the bank account is taken into account (both Post workplace square measure eligible)Interest financial gain from fastened Deposit, continual Deposit and bank account in Banks or Post workplace is eligible

Section 80TTB is sweet news for senior voters World Health Organization largely square measure obsessed on interest income for their post-retirement expenses.