Step by step instructions to CLAIM RELIEF WHEN SALARY IS PAID IN ARREARS OR IN ADVANCE

Whereby any bit of assessee's pay is gotten falling behind financially or ahead of time or by reason of his having gotten in any one monetary year pay for over a year or installment which under the arrangements of area 17(3) is a benefit in lieu of pay, he is henceforth burdened at a higher chunk than that at which it would somehow or another have been evaluated. The Assessing Officer will, on an Application made to him, give such help as endorsed. The Procedure for figuring the alleviation is given in Rule 21. This alleviation is given in the money related year in which such unpaid debts have been gotten.

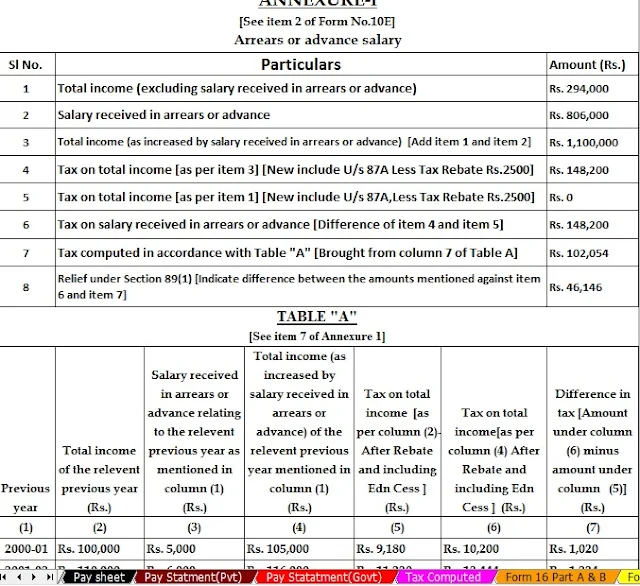

The Procedure to ascertain the measure of alleviation when compensation is paid financially past due or ahead of time:-

Stage 1 First of all, compute the expense payable of an earlier year in which the unpaid debts/advance pay is gotten on

1.Total Income comprehensive of Additional Salary

2. Add up to Income selective of Additional Salary The Difference between 1 and 2 is the assessment on extra pay Included in absolute Income.

Stage 2 Now ascertain the assessment payable of each earlier year to which the extra compensation relates to

3. The aggregate Income including Additional Salary

4. The Total Income barring Additional Salary Calculate the contrast between 4 and 5 for each earlier year to which the extra compensation relates and totals them.

Stage 3 The Admissible Relief will be the Excess between the duty on Additional compensation as determined under STEP 1 and STEP 2.

No help if: There is no abundance between the expense determined on Additional Salary (Step 1 and Step 2)

In regard of any sum got or receivable by an assessee on his deliberate retirement or end of his administration as per any plan, the assessee has guaranteed exclusion u/s 10(10C) in regard of such remuneration got on willful retirement in a similar evaluation year or some other appraisal year.

WHERE AND HOW TO FURNISH INFORMATION FOR CLAIMING RELIEF

In the event that where the assessee qualified for alleviation is an administration hireling or a representative in an organization, co-agent society, nearby expert, college, affiliation, foundation, he may outfit the points of interest to his manager who is in charge of making the installment alluded to in segment 192(1) in indicated frame 10E.

If there should arise an occurrence of different representatives, the application for alleviation will be made to the Assessing Officer rather than Employer.