Pay Commission is set up by the Government of India to the Government Employees and gives its suggestions in regards to changes in the compensation structure of its workers. Since India

What is Arrears of Salary?

Under Section 15 of the Income-assess Act, 1961, Salary is assessable when it is expected or when it is really gotten, whichever is prior with the exception of Arrears on Salary which are typically reported from a back date and in this manner can't be burdened when due. Any measure of compensation got from present or past business amid important earlier year and which identifies with some prior earlier years, is treated as unpaid debts of pay. It is assessable in the year in which it is gotten and not the year to which it has a place. In Current Scenario, Government representatives get their arrear on compensation in one evaluation year, when a worker gets unfulfilled obligations of pay for the earlier years, which was not exhausted before on due premise, at that point pay got is burdened on receipt premise. Taxability on such arrear increments considerably as it moves the Individual to a higher expense section or even prompts charging of additional charge and so on. With a view to conceding alleviation to Individual citizens in such cases, the present pay charge law permits help under segment 89 of the Income-assess Act, 1961.

What is Relief under Section 89 of the Income-impose Act, 1961?

On the off chance that an individual gets any bit of his compensation financially past due or in advances or gets benefit in lieu of pay, he can guarantee help as far as Section 89 read with Rule 21A of the Income-impose Rules, 1962. Calculation of help is being given in Rule 21A. Principle 21A(1) peruses as pursues: "Where, by reason of any bit of an assessee's compensation being paid falling behind financially or ahead of time or, by reason of any bit of family benefits gotten by an assessee being paid falling behind financially or, by reason of his having gotten in any one monetary year pay for over a year or an installment which under the arrangements of condition (3) of Section 17 is a benefit in lieu of pay, his salary is surveyed at a rate higher than that at which it would somehow or another have been evaluated, the alleviation to be allowed under sub-area (1) of Section 89 will be… " Here's the manner by which you can ascertain the expense help yourself–

Stage 1: Calculate assess payable on the aggregate pay, including extra pay – in the year when it is gotten.

Stage 2: Calculate imposes payable on the aggregate pay, barring extra compensation in the year when it is gotten. Subsequent to knowing the measure of unfulfilled obligations, one needs to ascertain the duty over the equivalent.

Stage 3: Calculate the distinction between Step 1 and Step 2.

Stage 4: Calculate impose payable on the aggregate salary of the year to which the overdue debts relate, barring unfulfilled obligations

Stage 5: Calculate charge payable on the aggregate salary of the year to which the overdue debts relate, including unfulfilled obligations.

Stage 6: Calculate the contrast between Step 4 and Step 5.

Stage 7: Excess of the sum at Step 3 over Step 6 is the expense help that will be permitted.

In the event that the sum in Step 6 is more than the sum in Step 3, no help will be permitted.

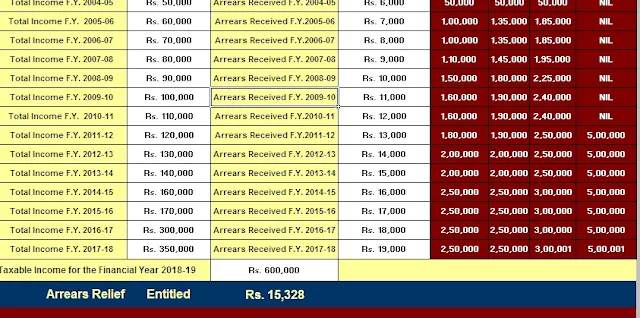

Download Automated Income Tax Arrears Relief Calculator U/s 89(1) With Form 10 E from the Financial Year 2000-01 to Financial Year 2018-19 [ Updated Version]