Both HRA and residential Loan Interest tax sections square measure unrelated. You claim the tax deduction on HRA (House Rent Allowance) underneath section 10(13A) whereas the tax deduction on payment of interest on home equity loan comes underneath section 24(b). but there may be problems if each the sections square measure used beside the intent of evasion.

We can have four things for folks claiming HRA tax deduction.

1. Rented house in situ of employment and own house in several towns

2. Own flat in a town of employment and remain rented house in the same town

3. Own flat in the town of employment and stick with parents/siblings within the same town and pay the rent

4. Rented house in several towns and own house at the place of employment

1. Rented house in situ of employment and own house in several towns

This is an awfully straightforward scenario to handle. you'll be able to simply claim the tax deduction on each and NO leader has an issue with this arrangement.

2. Own flat in a town of employment and remain rented house in the same town

This is the tough scenario. the primary logical question that involves mind is why would someone owning a house within the same town remain rent? Most employers have an issue with this arrangement and should not offer a tax deduction on each HRA.

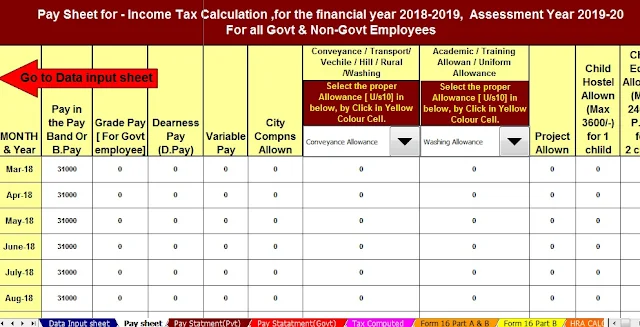

Download Automated Income Tax Preparation Excel Based Software All in One TDS on Salary for the Government & Non- Government Employees for the Financial Year 2018-19 [ This Excel Utility can prepare at a time your Income Tax Computed Sheet + Individual Salary Sheet + Individual Salary Structure + Automated Income Tax House Rent Exemption Calculation U/s 10(13A) + Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E + Automated Form 16 Part A&B and Form 16 Part B for F.Y. 2018-19 ]

But wrongfully you'll be able to claim a tax deduction on each if you'll be able to provide a valid reason for this arrangement. the explanations may be its a lot of convenient to remain. For e.g. your flat is on the outskirts with the virtually negligible conveyance, you would possibly not wish to measure there and rather keep about to your house of employment. the opposite reason may well be the closely-held home is smaller for the scale of family. There square measure misconceptions that there ought to be a minimum distance between 2 homes. All this is often a myth! All you wish a real reason to remain

Also if you progress to your new closely-held house within the middle of the economic year, its a real factor to try to and you'll be able to claim HRA for the amount you stayed on rent and house loan profit for the whole year. just in case your leader isn't able to offer a tax deduction on each – you'll be able to claim HRA tax deduction from a leader and claim the tax deduction on home equity loan whereas filing your tax come back.

The other question is ought to the closely-held house be assumed to possess notional rent? the solution is not any. If you receive actual rent then show, solely then you wish to pay tax on it.

3. Own flat in a town of employment and stick with parents/siblings within the same town and pay the rent

The situation is analogous as mentioned higher than with the distinction being your landholder or landlord is your shut relative like parents/siblings. Any such rental dealing is full with suspicion and then you must be terribly careful if you utilize this for tax saving. you want to do the following:

1. truly pay the rent through Cheque/ECS etc. and receiver ought to offer rent receipt for identical.

2. The landlord/lady ought to show this rent as “income from house property” and pay taxes on identical.

There are cases wherever rent paid to shut relatives are denied tax deduction by tax department as there was NO proof of actual dealing. therefore keep careful.

4. Rented house in several towns and own house at the place of employment

There could also be the case wherever you've got rented an area wherever your spouse/parents keep (in a unique city) whereas you own a house in a town of your employment and keep there. during this case, you can't claim HRA tax deduction as HRA is bought staying on rent for purpose of employment. but you'll be able to simply claim home equity loan tax deduction.