As per the Income Tax Rules, the salaried person’s Salary Certificate Form 16 Part B is mandatory to download from the Income Tax TRACES portal. And the Income Tax Salary Details Form 16 Part B is must be prepared by the Employer.

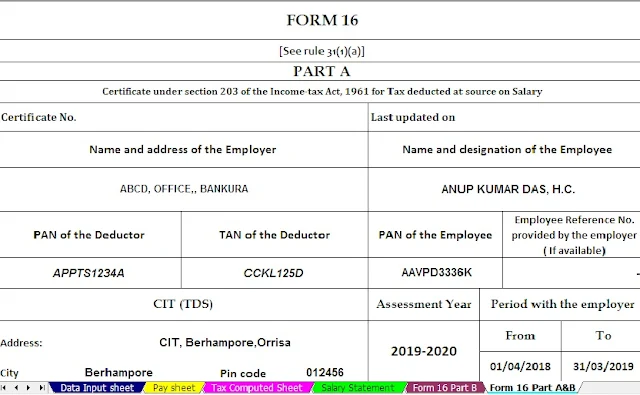

Now the Income Tax Salary Certificate Form 16 is Two-Part. One is Part A, which can download from the Income Tax TRACES portal and in this Part A is available the Tax Deduction and Deposit portion, And another Form 16 Part B have the salary details of employee’s.

But It appears that Sum of the Govt & Non-Govt Concerned not known about this system and they can not able to download the Form 16 Part B from the TRACES Portal.

You can download the Excel Utility from the below link which can prepare Automated Income Tax Form 16 Part A& B and Part B for F.Y. 2018-19

Click here to Download the Automated Income Tax Form 16 Part A&B and Part B for the Financial Year 2018-19 & Assessment Year 2019-20 [This Excel Utility can prepare One by One Form 16 Part A&B and Part B For F.Y. 2018-19]

The Main Feature of this Excel Utility is:-

1) Prepare One by One Form 16 Part A&B and Part B for F.Y. 2018-19

2) After filling the Salary Details Form 16 will be prepared automatically and perfectly as per the Rules by the Income Tax Department.

3) All latest Amended Income Tax Section have in this Excel Utility

4) Prevent the Double Entry of any Employee's Name and Pan Number automatically.

5) Automatic Convert the Amount into the In-Words without any Excel Formula.

6) Easy to install just like as an Excel File and Easy to Generate

7) Save the time to prepare Form 16 Part B One by One of each employee's