The Interim Upkeep has given interval alleviation to the central registration citizens. Here's everything you have to know.

The present edge for applying TDS on intrigue salary (other than enthusiasm on securities) is proposed to be expanded from Rs 10,000 to Rs 40,000.

There had been much discourse on what the Finance Minister will give to charm the overall man. Be that as it may, as observed from the Interim Upkeep 2019 exhibited on 01 February, the administration shunned making huge declarations as it is just 3 months outperforming the new government shows an undeniable Upkeep in July 2019. The Interim Budget, consequently, has given between time alleviation to the central registration citizens. Key alleviation measures are condensed beneath:

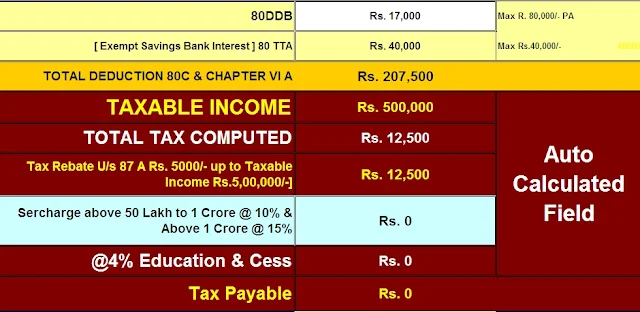

Download and Calculate your Income Tax Liability for the forthcoming Financial Year 2019-20 & Ass Year 20120-21 as per Budget 2019

Expense Rates

There are no progressions proposed in the expense chunks/rates. In any case, it is proposed to give an improved refund up to Rs 12,500 to a person with assessable pay up to Rs 500,000. Right now, the refund is misanthrope up to Rs 2,500 to a person with assessable pay up to Rs 350,000. Citizens with assessable pay whilom Rs 500,000 would have nil advantage.

The increment in the standard derivation limit

Standard reasoning was represented in the last upkeep for salaried representatives. It is proposed to build the cutoff from Rs 40,000 to Rs 50,000. Every single salaried representative would goody from this and the expense goody would run from Rs 2080 to Rs 3588 (counting extra charge and cess).

Free Download Income Tax Automated Form 16 Part A&B for the Financial Year 2018-19 [ This Excel Utility Prepare at a time 50 Employees Form 16 Part A&B] { Who are not able to download the Form 16 Part A from the Income-tax TRACES Portal, they can use this Excel Utility}

House property

Till now, under current assessment arrangements, in the event that an individual possessed progressively than one house property for self-occupation, at that point just a single house property was considered as self-involved and the other property was liable to charge depending on a notional lease plane if the property was not irrefutably let out.

It is presently proposed to proffer 'oneself involved property tag' to two private houses as versus one prior. As needs are, the second self-involved house property would besides not be liable to assess on notional premise.

This would goody all citizens who didn't have a lodging advance. Accordingly, they were not the final proposal any intrigue conclusion and needed to settle regulatory expense on the notional lease. Be that as it may, citizens with lodging advances and final offer intrigue finding would be antagonistically affected. The intrigue conclusion in volume for 2 self-involved house properties would be confined to Rs 200,000. Therefore, one could be losing on the direct forward/set off advantages as misfortune from the second house property could be set off or conveyed forward for a long time to be set off versus salary under the position of authority house property.

At present, where the property is held as a stock-in-exchange and not let out inside a year from the finish of the money related year in which the fulfillment record is acquired from the equipped expert, the yearly esteem is considered as nil and along these lines not expose to impose. It is proposed to expand the opportunity time frame/exclusion period from 1 year to 2 years.

TDS on intrigue and rental pay

The present edge for applying TDS on intrigue salary (other than enthusiasm on securities) is proposed to be expanded from Rs 10,000 to Rs 40,000. This will be a major help for little salary gathering, non-working companions or beneficiaries who needed to document an expense form just to prerequisite an assessment discount.

Further, the present edge for applying TDS on a lease is proposed to be expanded from Rs 180,000 to Rs 2,40,000.