The administration has given different approaches to spare the expense, for example, area 80C, 80D and so forth. By utilizing these arrangements, you can limit your duty outgo. Yet, every technique for assessment sparing has a breaking point. Any overabundance venture or cost would not remunerate any tax reduction. Indeed, even a few ventures have their very own farthest pointe; g. PPF.

80C Tax derivation Limit

The segment 80C in the salary charge act has the greatest rundown of duty reasonings. In this area, there are numerous ventures and costs which are qualified for expense findings. The cash put resources into the given instruments is decreased from your assessable salary. It results in diminished assessment risk. In light of this segment, you can set aside to Rs.46,350 of the expense. The speculation qualified for assessment derivations are-

1. PPF

2. EPF

3. ELSS

4. ULIP

5. Insurance

6. NPS

7. SCSS

8. NSC

9. Tuition Fees

10. Pension Scheme

As far as possible for area 80C finding is Rs.1.5 lakh. This point of confinement is serviceable to the volume sum. To summate the volume esteem the majority of your interest in PPF, ELSS, EPF and so forth is tallied. The duty finding would be misanthrope just up to the 1.5 lakh. The excess speculation over this esteem would not remunerate any tax cut. In the pay government form, when you compensate subtleties of your venture, the finding is constrained to 1.5 lakh. You may have seen that the framework takes the estimation of Rs 1.5 lakh, imagine a scenario in which your absolute venture surpasses.

80D Limit

The area 80D of the salary charge act gives you progressively charge conclusion. It is finished and whilom as far as possible. In the area 80D, the cost of wellbeing is considered for duty reasoning.

• The 80D breaking point is from Rs 25,000 to 1 lakh rupees. The cutoff fluctuates on the understructure of the age.

• This segment gives a duty conclusion for the premium of medical coverage and preventive wellbeing registration.

• In the example of the senior native, the conclusion is in addition given for the restorative consumption yet the individual ought not to have medical coverage.

• You can necessity the uneaten charge conclusion for the restorative cost on your reliant guardians.

• The charge derivation limit is higher if the cost has appeared on the senior resident.

As far as possible for you and your family

As far as possible for the medical coverage premium of you and your family is Rs 25,000. You family incorporates your companion and your kids. This breaking point also incorporates preventive wellbeing registration. The wellbeing registration has a sub-breaking point of Rs 5,000. Give us a chance to comprehend it from a precedent.

Under segment 80D, there is an uneaten conclusion sexist on the off chance that you spend on the medical coverage premium of your folks. The farthest point for this uneaten conclusion is Rs 25,000

Benefits of Limit For the Senior Citizens

The administration perceives the higher restorative cost for the senior natives. In this manner, the 80D reasoning farthest point is higher for senior residents. On the off chance that medical coverage premium is paid for the senior natives, the derivation would be Rs 50,000. This higher farthest point is in addition useful for your senior resider guardians.

Assume you are a senior resider and additionally have subordinate senior resider guardians. For this situation, you would requirement be able to impose derivation up to Rs 50,000 for yourself and flipside Rs 50,000 for your folks. Thus, the all-out duty reasoning farthest point under segment 80D would be Rs 1 lakh.

On the off chance that a senior resider (you or your folks) don't have health care coverage, he/she can in addition prerequisite the medicinal cost for the reasoning.

80D points of confinement in variegated situations

1. You and your companion are unelevated 60 and don't have subordinate guardians – Rs 25,000

2. You, companion and ward guardians are unelevated 60 – 25,000 + 25,000 = Rs 50,000

3. You and mate is unelevated 60 however ward guardians are senior natives – 25,000 50,000 = Rs 75,000

4. You, life partner and ward guardians are senior natives – 50,000 + 50,000 = Rs 1 lakh

NPS Limit

The interest in NPS is additionally qualified for expense conclusion. It gets finding under 3 separate tenets.

• The pay charge act's segment CCD (1) gives a charge conclusion on your NPS commitment. The finding is restricted to 10 % of your gross compensation. For Non-salaried this point of confinement is 20% of gross salary. Note, charge conclusion sexist under this area is liable to the volume furthest reaches of 1.5 lakh (Section 80CCE).

• Under Section 80 CCD (1B), your intentional commitment to NPS conspire is qualified for the uneaten charge derivation of Rs 50,000. Note, If NPS commitment is deducted compulsorily by your boss, you would not get goody under this area. That is to say, government workers can't a necessity this derivation for their obligatory NPS store. They can put uneaten esteem into the NPS worth to profit goody of this segment.

• The commitment by the business in your NPS worth is in addition qualified for expense exception. This ought not to be progressive than 10% of your indispensable pay in addition to DA. Note, this finding is misanthrope just to the salaried worker.

Home advance Tax Deduction Limit

In the event that you take a home credit, you get the expense goody in 3 different ways. All these 3 different ways have the breaking points.

1. Under segment 24 – Your home advance intrigue installment is qualified for duty conclusion. This is constrained to 2 lakh for each year. In the event that you can't all around built the home development inside 5 years, the breaking point would come lanugo to 30,000 every year.

2. Under area 80EE, the administration gives uneaten charge reasoning on home credit intrigue. This is finished and whilom the 2 lakh breaking point. The finding under this segment is constrained to Rs 50,000.

3. The home credit main installment is in addition qualified for assessment conclusion. It is the piece of volume area 80C farthest point that is Rs 1.5 lakh.

PPF Investment Limit

The open provident store is a standout amongst the most well-known duty sparing ways. The speculation into the PPF worth is qualified for expense derivation under segment 80C. Henceforth, the duty goody is restricted to the general furthest reaches of 1.5 lakh. Also, your venture to PPF worth can't go vastitude Rs 1.5 lakh every year. Any excess commitment would not acquire any intrigue.

Tax-Exempt Income Limit for individual and Senior residents

Your full payment isn't at risk to salary charge. Or maybe, the administration let everybody appreciate the tax-exempt pay up to the farthest point. For an individual, the salary of up to Rs 2.5 lakh is tax-exempt. This exclusion is a misanthrope to everybody, rich and poor. For a senior native, the tax-exempt pay limit is 50,000 more. It is Rs 3 lakh for each year

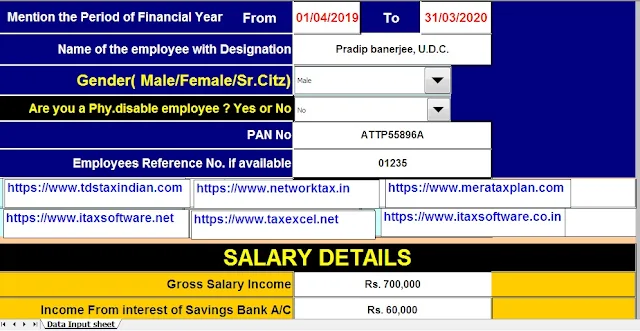

Free Download Automated Income Tax Calculator for the Financial Year 2019-20 and Assessment Year 2020-2021 as per Budget 2019 [You can make out your Tax Liability for the forthcoming Financial Year 2019-20]