Recently the CBDT has changed the Format of Income Tax Salary Certificate Form 16 Part B Vide Notification No. 36/2019 Dt. 12.4.2019. This new format effect from 12th May 2019.

The new Financial Year has already started from the date of 1st April 2019 and will end on the 31st March 20120.

It is most important that you must check your Income Tax Liability for the Financial Year 2019-20 and Assessment Year 20120-21, so you can planning your Tax Savings for the F.Y. 2019-20.

In this regard the below given Excel Based Income Tax Software TDS on Salary All in One for Govt & Non-Govt Employees for the Financial Year 2019-20 and Ass Year 2020-21 with all the Amended by the Finance Budget 2019 and the New Format of Form 16 Part B.

Download Automated Income Tax TDS on Salary All in One for Govt and Non-Govt(Private) employees for the F.Y. 2019-20.

This Excel Utility Provide you:-

1) I will calculate your Income Tax Liability for F.Y. 2019-20 after filling your Salary Data2) In building the Salary Structure as per the Govt and all Non-Govt Employees Salary Pattern

3) Automatic Calculate your House Rent Exemption Calculation U/s 10(13A )

4) Automated Income Tax Arrears Relief Calculator from the F.Y. 2000-01 to F.Y. 2019-20 with automated Form 10E

5) Automated Income Tax Salary Sheet for both Govt & Non-Govt employees

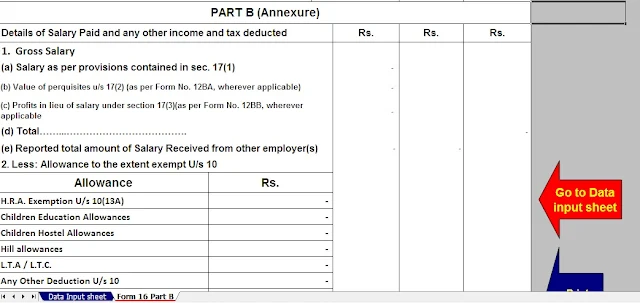

6) Automated Income Tax Form 16 Part A&B in the new format of Form 16 Part B as modified by the CBDT vide Notification No. 36/2019 Dt. 12.4.2019

7) Automated Income Tax Form 16 Part B for F.Y. 2019-20 ( Amended Format of Form 16 Part B.