Methods to get maximum profits tax benefits from domestic loans u.s.80c, 24 and 80ee

Many of us won't aware about the maximum advantages which may be to be had via domestic loans. you might be planning to shop for your first residence through taking a home mortgage. one is probably looking to buy a buy home mortgage for the self-occupied property. there are three methods wherein a character can get an income tax benefit from home loans. what are the profits tax advantages for getting home through domestic loans for the first time u.s.a.24 of earnings tax act? what are the tax gain for buying domestic through domestic loans united states80c and u.s.80ee? what are the maximum earnings tax advantages to be had below those sections 80c, 24 and 80ee?

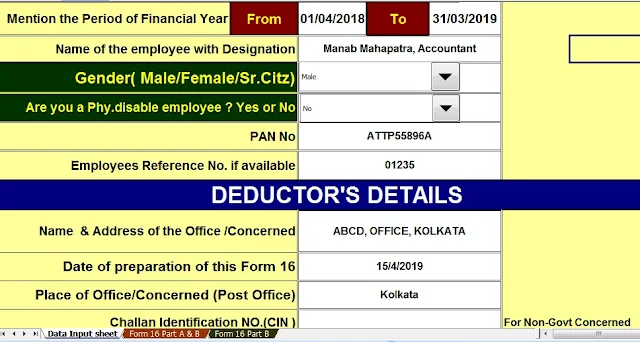

Download Automated calculator for Income Tax Value of Perquisite U/s 17(2) ( All in One)

What are domestic loans?

You could bypass this section if you are privy to a home mortgage.

a home mortgage is a monetary help given by using a financial institution or monetary group to a person to buy property. the title or deed of the assets is held back by the organization until the loan is repaid absolutely with interest.

the documents required for home loan varies from bank to bank. however, here's a listing of common files.

identity proof – it consists of aadhar card, passport, driving license, pan card or voter identification.

Deal with proof – it includes evidence of your current house in which you have to offer any software payments.

Financial institution announcement – last three month or 6 months as required.

Earnings assertion – closing three months (for salaried human beings)

Profits evidence – it includes audited financials for the remaining 2 years (for self-hired)

Who does home mortgage email contains?

The house mortgage which is acquired from the bank is repayable in equated monthly installments (EMI). this installment consists of two additives- predominant quantity and interest. EMI is an unequal aggregate of essential and interest additives. in the initial degrees, the compensation is more to hobby amount than to principal quantity. however, as the time passes and also you reach towards the stop of repayment tenure, greater of important is repaid.

When you have got a lump sum amount of money, you could make use it closer to the element fee of the loan, this reduces your email or loan tenure.

Download & Prepare at a time 50 Employees Income Tax Form 16 Part A&B for F.Y. 2018-19 [ This Excel Utility can prepare at a time 50 employees Form 16 Part A&B] (How are not able to download the Form 16 Part A from the TRACES Portal)

Three ways to get most earnings tax advantages from home loans usa80c, 24 and 80ee

There are one-of-a-kind treatments for the reimbursement of principal quantity and the hobby paid off the home loan. tax benefit on reimbursement of the primary amount can be claimed below segment 80c. tax benefit on the compensation of home mortgage hobby is permitted united states of america24 as well as united states80ee of the profits tax act, 1961.

1) Earnings tax benefits united states80c

The quantity paid as repayment of the major amount of domestic mortgage is permitted as deduction underneath section 80c of the income tax act, 1961 concern to the maximum limit of rs a hundred and fifty,000. this tax advantage can be availed only once the construction of the house is completed. no deduction is permitted when the house is beneath creation duration via this segment. if you have no longer exhausted 80c through other tax saving funding alternatives, home mortgage important quantity can be claimed as a part of this phase to avail tax benefits.

2) Income tax advantages U/s 24(B)

This advantage is available only whilst the loan is taken on or after 1st April 1999 for the purchase or production of the residence but not for maintenance or preservation. the purchase or construction needs to be finished within five years from the top of the monetary year wherein the loan turned into taking.

If the house is self-occupied – as per phase 24, the maximum quantity of deduction that can be claimed closer to the repayment of interest amount is Rs. 200,000. the amount is claimed below the head “loss from residence belongings”.

If the house isn't self-occupied due to task/business being in every other city – there is additionally an opportunity that the belongings aren't self-occupied and the person is staying at another area because of his employment or business, then, a fixed quantity of rs 200,000 shall be considered for deduction

Belongings are rented – in case the assets aren't self-occupied but rented, the lease acquired may be taken into consideration as earnings and the interest paid might be claimed below deduction. if the man or woman’s interest paid is greater than hire then it is able to be activated as loss from residence belongings and maybe deduction from the taxable earnings. there may be no maximum restrict to be claimed right here.

The way to treat pre-construction hobby?

in case of emi starting before pre-creation period, following hints might observe

1) Buy / creation mortgage – interest paid prior to the creation period may be claimed as a deduction in five same installments for subsequent 5 economic years.

2) Reconstruction/upkeep loan – no tax deduction could be to be had for the interest paid until the construction is finished.

In finances 2016, this segment added. the advantage u.s.a.80ee can be availed only with the aid of those individuals who are first-time domestic shoppers. the deduction allowed below this segment is for hobby paid on a home mortgage up to a maximum of Rs 50,000 each economic yr till the home mortgage is completely paid. one essential factor to observe in this relevance is that the mortgage amount must not exceed Rs. 35 lakhs and assets price have to no longer exceed Rs 50 lakhs to avail this gain. The house loan should have been sanctioned after 1st April 2016 and before thirty-first march, 2017. this exemption is over and above the restriction under sec 24.

Download & Prepare at a time 100 Employees Form 16 Part B for F.Y. 208-19 [ This Excel Utility can prepare at a time 100 Employees Form 16 Part B as per the latest Finance Budget 2018-19]

The most gain that can be availed by using an individual in the event that they fulfill all of the situations is Rs. 400,000.

1) You'll be able to avail most Rs. 150,000 (towards the compensation of major quantity) united states of america80c if he has no longer claimed every other deduction underneath this section.

2) They are able to declarers two hundred,000 (towards reimbursement of hobby quantity) u/s.24(B)

three) further Rs. 50,000 (in the direction of reimbursement of hobby quantity for first time home shoppers) u.s.a.80ee.