Everybody gets

stressed amid the period of accommodation of salary charge. A few people will

in general contract attorneys to spare the most extreme measure of cash.

Meanwhile spending plan of the year 2019, there were different assessment

proposition that would modify the lives of almost 30 million Indian salaried and

beneficiaries. While no changes have been made in the expense piece, however

because of assessment recommendations kept in this financial limit, individuals

who get not as much as Rs. 5 lakh will get a full duty discount. For

individuals procuring more than Rs. 5 lakhs, different alterations have been

executed to diminish the weight of their expense.

Here is a portion of

the manners in which other than segment 80C by which you can spare pay charge

in the evaluation year 2020-21.

Section 80D

Taking a gander at the

increasing expenses of human services treatment, it has turned out to be

fundamental for a typical man to buy medical coverage. Aside from this, it can

likewise profit you to spare assessment under Section 80 (D). This favorable

position is pertinent to the premium paid for your better half, youngsters, and

guardians. Under area 80 (D), you can guarantee independently for duty

conclusion up to Rs 25,000.

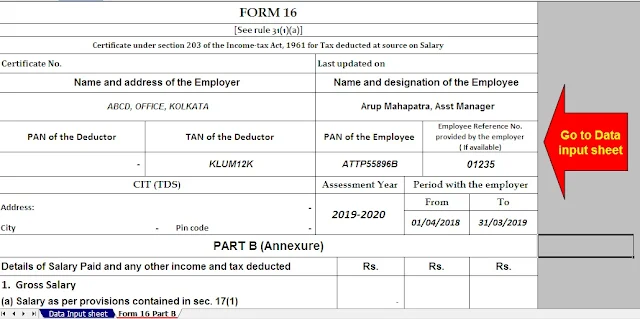

Download Automated All inOne TDS on Salary for Govt & Non-Govt Employees for F.Y. 2019-20 & A.Y.20120-21 [ This Excel Utility can prepare at a time your Tax Computed

Sheet +Individual Salary Structure for common Salary Structure for Govt &

Non-Govt Employees Salary Pattern + Automated Arrears Relief Calculation with

Form 10e From F.Y. 2000-01 to F.Y. 2019-20 + Automated Income Tax New Format of

Form 16 Part B + Automated Form 16 Part A&B for F.Y. 2019-20 ]

Section 80E

Section 80G

On gifts made to

specific assets, beneficent organizations, or some other government help, one

can guarantee for money charge reasoning under Section 80 (G). Be that as it

may, the assets or gifts made ought not to surpass 10% of the gross all-out

salary. What's more, the gifts given in real money can get tax cuts just in the

event that it is not as much as Rs 2,000.

Section 80TTA

The measure of premium

earned on Savings Account can be benefited from under this segment. Enthusiasm on

the Savings Account ought to be incorporated into 'Pay from Other Sources',

which can profit the conclusion under Section 80 (TTA). The farthest point of

the hike the amount from Rs. 10,000/- to Rs. 50,000 for the Financial Year

2019-20

Section 80 (CCD)

By putting resources

into NPS, one can guarantee an expense derivation up to Rs. 50,000 under

segment 80 (CCD).