$ Go to e-File >> Income Tax Forms

Under "Form

Name", select "FORM NO. 10E - Form for relief u/s 89".

Select the Assessment Year for which Form 10E is to be

filed. For example, if arrears of salary is received in the Assessment Year

2018-19 (Financial Year 2017-18), select Assessment Year as 2018-19.

$ Select the Submission mode

$ Click on

"Continue"

$ Fill the relevant details. Click on

"Save Draft" to save the Form.

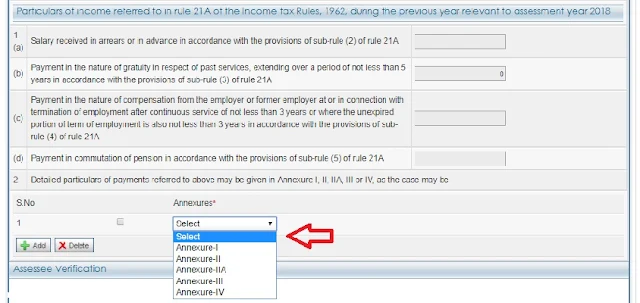

In the tab Form 10E, select the Annexure you want to fill.

The selected Annexure will then be available in editable Format. For

Arrears of Salary, please select Annexure-I.

For example, Annexure-I will appear as below. Likewise other

Annexures will appear. Fill the details as applicable to you and proceed

further. Annexure-I is for Arrears or Advance Salary

Annexure-II is for Gratuity (Past services over 5 years but less than 15

years)

Annexure-IIA is for Gratuity (Past services for 15 years or more)

Annexure-III is for Compensation on Termination of employment

Annexure-IV is for Commutation of Pension

Click on "Preview

& Submit" and then submit the Form.