Interim Budget 2019 which came in February 2019 had given bunches of duty sops along these lines there was no such desire identified with unwinding of annual assessment section, charge rates or any more reasoning from Nirmala Sitharaman lady Budget.

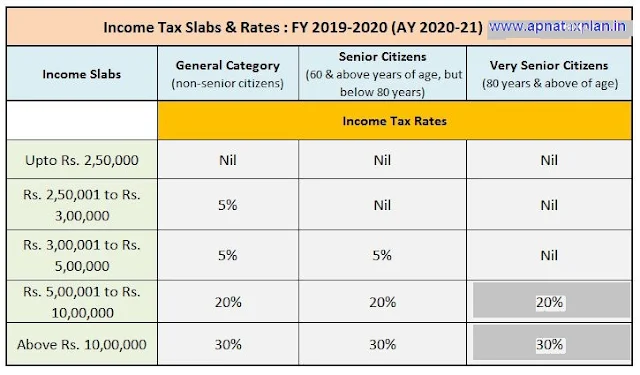

The following are the Income Tax Slab, Income Tax Rates and Tax-Credit relevant for Assessment Year 2020-21 and Financial Year 2019-20.

Assessment Rebate under Section 87A for AY 2020-21 for example FY 2019-20

Assessment Rebate under area 87A is accessible for the pay up to Rs. 5 lakhs (Rs. 3.50 lakhs prior). Following conditions will be met for asserting the assessment refund under segment 87A.

1. The assessee must be an Indian Resident.

2. The absolute pay after derivation under area 80 will not surpass Rs. 5 lakhs.

3. The all out assessment refund is limited to Rs. 12,500. That implies, if the all out annual expense obligation of the assessee comes up to Rs. 12,500 or lower at that point no duty will be payable.

4. This duty discount under segment 87A is connected to the all out expense before including the Health and Education Cess of 4%

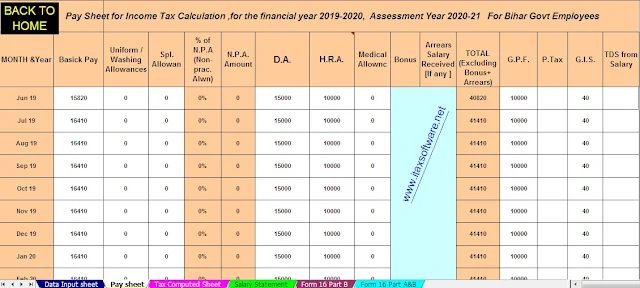

Download Automated All in One TDS on Salary for The Bihar State Govt Employees for the Financial Year 2019-2020 and Assessment Year 20120-2021 With New Format of Form 16 Part B.

The feature of this Excel Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as per new Finance Budget 2019

2) The Salary Structure as per the Bihar State Govt employees Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption Calculation U/s 10(13A)

6) Automated Income Tax Form 16 Part A&B for F.Y. 2019-20

7) Automated Income Tax Form 16 Part B for the F.Y. 2019-20