Under the Income Tax Act, 1961, income is chargeable to tax under five heads, one of the major heads being income under the head 'salary’. Your tax return with respect to your incomes should be filed timely with all documents and fulfillment of other requirement so you are entitled to all reliefs, refunds, and deductions.

In case of failure to file timely income tax returns, you may face penalties and fines or even imprisonment under the Income Tax Act.

In the light of income under the head ‘salary’, the general rule of charging salary to Income Tax in India is that it is taxed when it is actually received and not when it accrues. However, on certain occasions, it may so happen that the salary may accrue to you in one year and received by you in one of the subsequent years.

The question arises as to how to adjust such arrears of salary received in a year different from the one in which it accrued.

The Income Tax Act, 1961 takes due note of such practice of receiving salary and provides a provision in the act to deal with the same.

Section 89(1) of the Act caters to it.

In this article, we tell you how this provision comes to the rescue of taxpayers in India and how it can save you from paying exorbitant taxes for money that did not even accrue in that particular financial year.

What Is Section 89(1) and Relief There under?

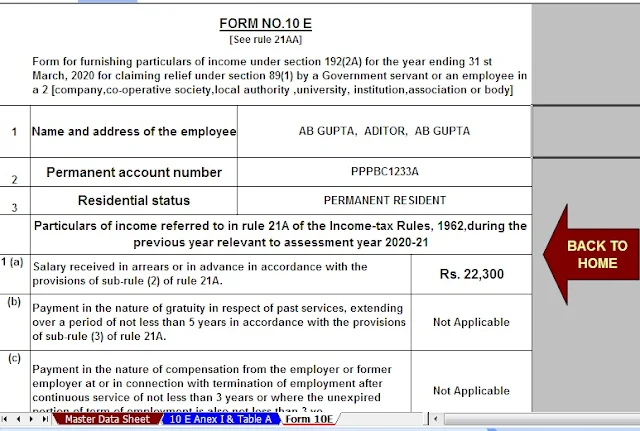

Section 89(1) allows you to adjust your salary that has accrued in a different financial year but received in a subsequent financial year and thus allows reliefs to several taxpayers. It provides for the filling of Form 10E that is mandatory in order to claim such relief.

The primary purpose for providing such relief is to ensure that a particular taxpayer does not fall in the higher tax bracket simply because of its previous salary that was received in the year in which it accrued. Additionally, it also saves the taxpayer from paying high taxes for income that did not even arise in that financial year.

For your information, the Income Tax Act, 1961, bifurcates taxpayers according to their total income. For instance, a person under the age of 60 years shall be exempted from paying income tax if his annual income is up to INR 2,50,000 and shall pay a tax of 5 percent if his income is between INR 2,50,000 and 5,00,000 and so on.

In case the arrears of previous years or advance salary amounts are all added into a single financial year, the taxpayer would have to face acute hardship while paying taxes since his income tax slab would only rise thus letting him pay a great deal of income tax. Often, such practices also deter people from paying taxes, thus leading to a slump in the economy of the country.

In the subsequent section of this article, we explain, using steps, how you can calculate your tax relief with respect to your salary under Section 89(1) and what is the process to file Form 10E which is mandatory to claim relief under the section. These steps are extremely simple and you do not need an income tax expert to do the needful. All you require is an ascertained amount of your salary and an internet connection.

How to Calculate Your Tax Relief Under Section 89(1)?

In case you have received a part of your salary in advance or in arrears, you can claim tax relief under Section 89(1) that is to be read with Rule 21A of the Income Tax Rules.

Here are the steps that you need to follow to calculate your relief:

- Calculate the tax on your total income inclusive of the salary received from any previous year or advance salary.

- Calculate tax payable on your total income without adding such arrears or advance.

- Calculate the difference of both the amounts arrived at.

- Calculate tax that is payable on your total income of that year in which the arrears arose by subtracting such arrears.

- Calculate the tax payable of the aforementioned year by now including the amount of such arrears.

- Calculate the difference of both the amounts arrived at.

- In case the amount arrived at in Step 3 is more than that in Step 6, the assessee is entitled to relief under Section 89(1). In case the amount in Step 6 exceeds Step 3, no relief can be claimed under the head ‘salary’.