Gratuity refers to the money received by an employee from his employer at the time of:

- Retirement

- Resignation

- Termination

- Death

Gratuity is payable only to persons who have been employed for 5 years or more with the employer. In case of death, disease or accident, the time limit of 5 years is not applicable.

Income tax rule is different for government employees and non-government employees. This money is fully exempted in the hands of central or state government employees. [Discussed in detail]

In this article, we will cover the taxation of gratuity in detail, its exemption, and calculation.

Gratuity Received by Government Employee [U/s 10(10)(i)]

The gratuity received by employees of the following are exempted from income tax:

- State government

- Central government

- Local Authority like Municipality

This exemption is not available to the employees of a statutory corporation like Airport Authority of India (AAI), NHAI, FCI, etc.

Further, in case of the death of government employees, the gratuity received by the widow or dependent children shall not be fully exempted. [covered under section 10(10)(iii)]

Gratuity Received by Non-Government Employee

Income tax rule further divided non-govt employees into two part:

- Covered under Payment of Gratuity Act, 1972

- Not covered under the Payment of Gratuity Act, 1972

From 29th March 2018, gratuity up to Rs.20 lakh is exempted in the hands of private and public sector employees. Previously it was Rs. 10 lakh.

1. Gratuity Exemption Limit for Non-Government Employee Covered under Gratuity Act [u/s 10(10)(ii)]

Employees of a factory, mine, oilfield, plantation, port, and the railway company, shop and other establishments with 10 or more employees at any time during the preceding 12 months are covered under the Payment of Gratuity Act.

Once an establishment is covered, this act will apply even if the number of employees falls below 10.

In this case, gratuity will be partially exempted and the remaining amount will be taxed as Salary Income.

The exemption, in this case, will be lower of the following amounts:

- Last drawn Monthly Salary (Basic+DA) x no. of years of employment* x 15**/26

- 20,00,000/- [When gratuity received on or after 29-03-2018]

- 10,00,000/- [When gratuity received before 29-03-2018]

- Gratuity actually received

*Number of the year of employment should be rounded off to the nearest years. Example: For 20 years 7-month service takes employment years like 21 years.

**7 days instead of 15 days in case of employees of a seasonal establishment.

Example:

Mr. Ram a brick factory worker who’s Basic Pay Rs.30000 + D.A.Rs.15000 He has completed 19 years 2 months of employment. His Date of Retirement is On 31st December 2018 OR Service of length is 19Years 6 months 1Day i.e. 19 years.

Find the exempted and taxable gratuity value for FY 2019-20.

Solution:

Calculation of exempted and taxable Gratuity amount

|

||

Particulars

|

Amount

|

|

Least of the following will be exempted:

|

||

Monthly salary+D.A.* x 19 (employment years) x 15/26

|

5,60250/-

|

|

Prescribed limit

|

3000000

|

|

Gratuity actually received

|

5,60250/-

|

|

Gratuity Calculator inExcel for Exemption Limit for Non-Government Employee under Gratuity Act[u/s 10(10)(iii)]

*Mr. Ram is received. Actual Gratuity 5,60,250/-

2.Gratuity Exemption Limit for Non-Government Employee Not-Covered under Gratuity Act [u/s 10(10)(iii)]

Many employers provide gratuity benefits to their employees voluntarily.

In this case, the income tax exemption formula is different. It is lower of the following amount:

- Last 10 month’s average Salary*(Basic+DA+ fixed % of commission on sale) x 0.50 x no. of years of employment**

- 20,00,000/- [This value is for gratuity received on or after 29-03-2018]

- 10,00,000/- [This value is for gratuity received before 29-03-2018]

- Gratuity actually received

* The last 10 months doesn’t include the month of retirement, termination or death.

*Number of the year of employment should not be rounded off to the nearest years. Example: For 20 years 7-month service takes employment years like 20 years.

Note for section 10(10)(iii):

The above formula also applies to the gratuity received by the widow, children or dependents of the dead employee.

For calculating exemption, in this case, the status of the dead employee is irrelevant.

The un-exempted portion of gratuity value will be taxable in the hands of the recipient as Income from other sources.

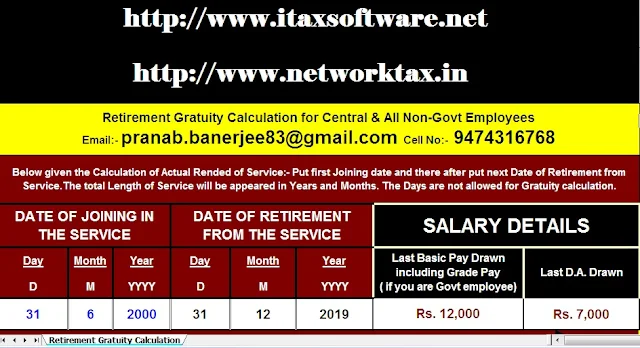

Download All in One TDS on Salary for Govt& Non-Govt Employees for the F.Y.2019-20 and A.Y. 2020-21 With H.R.A.Exemption Calculation U/s 10(13A) + Automated Form 12 Ba for f.Y. 2019-20 +Gratuity Calculator

The feature of this Excel The utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as

per new Finance Budget 2019

2) The Salary Structure as per the All of Govt &

Non-Govt (Private) employee’s Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption

Calculation U/s 10(13A)

6) Automated Income Tax Form 16 Part A&B for F.Y. 2019-20 in

New Format

7) Automated Income Tax Form 16 Part B for the F.Y. 2019-20 in

New Format

8) Automated Income Tax Arrears Relief Calculator U/s 89(1) with

Form 10e from F.Y. 2000-01 to 2019-20

9) Automated Gratuity Calculator for Income

Tax Exemption [U/s 10(10)(iii)]