Since there has been a tremendous increase in the numbers of income tax return filers in very recent years, the Central Government has embraced this act of taxpayers , and as a result, in the Finance Bill 2019 introduced or rather I would say enhanced the existing income tax rebate u/s 87A of the I.T Act up to 12500 from the F. Y 2019-20. On the other hand, this decision of the Government has made the middle-class people very much happier as this would leave them richer by Rs Rs.12500 annually.

The Finance bill 2019 may be read to the extent of rebate clause only as follows:–

Clause 8 of the Bill seeks to amend section 87A of the Income-tax Act to provide relief to the individual taxpayers by increasing the maximum amount of tax rebate to twelve thousand five hundred rupees from the existing two thousand five hundred rupees. The tax rebate shall now be admissible to taxpayers having total income up to five hundred thousand rupees, instead of existing three hundred fifty thousand rupees.

What is a Tax Rebate?

Before, going in to detail on should know what a tax rebate is all about. Rebate means acknowledging your liability to pay tax but allowing you relief or deduction so that you don’t need to pay your tax liability on the fulfillment of certain conditions. This means the Government is granting you a relief to pay tax up to a certain limit on attaining certain conditions. Further, as per Wikipedia, a Tax Rebate can be defined as the refund of taxes when the tax liability is less than the taxes paid.

So, a tax rebate is basically a refund of tax which an individual can claim upfront from his income tax liability. There is a tax liability for you but you are not supposed to pay that as per the rebate u/s 87A. However, this tax rebate is applicable only to small taxpayers.

Eligibility factors to claim tax rebate u/s 87A for F. Y 2019-20

The following factors or conditions need to be fulfilled before claiming deductions or rebate u/s 87A.

- One needs to be a resident INDIAN;

- Your Net Taxable Income i.e. total income after all deductions u/s 80C to 80 U is less than or equal to Rs.5.00 Lakh;

- The maximum rebate U/S 87A is capped at Rs.12500 only. If your tax liability before adding Cess@4% is below Rs.12500, then you will be allowed rebate up to that amount only;

- No Non-Resident Indian is entitled to this rebate;

- No HUF, partnership firm or company is entitled to this rebate.

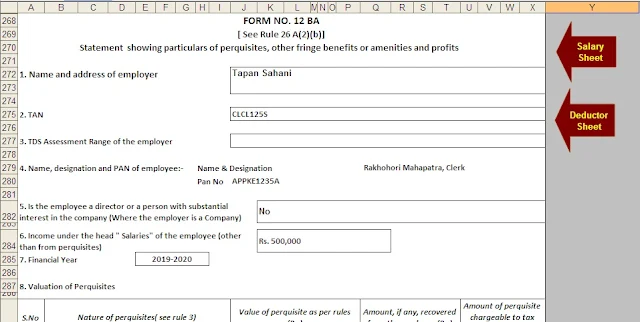

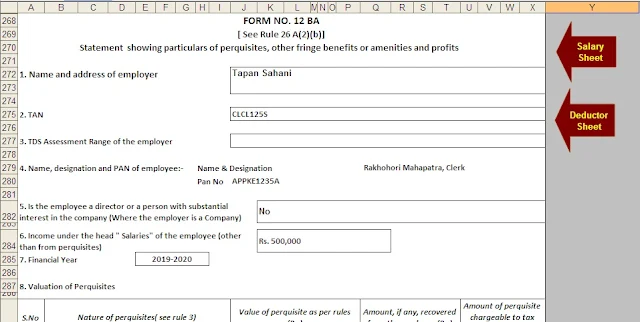

Download All in One TDS on Salary for Non-Govt Employees for the Financial Year 2019-2020 and Assessment Year 20120-2021 With H.R.A. Exemption Calculation U/s 10(13A) + Automated Form 12 Ba for f.Y. 2019-20

|

| FOR PRIVATE OR NON-GOVT EMPLOYEES SALARY STRUCTURE |

AUTOMATED FORM 12 BA FOR VALUE OF PERQUISITE

The feature of this Excel Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as per new Finance Budget 2019

2) The Salary Structure as per the All of Non-Govt(Private) employee’s Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption Calculation U/s 10(13A)

6) Automated Income Tax Form 16 Part A&B for F.Y. 2019-20 in New Format

7) Automated Income Tax Form 16 Part B for the F.Y. 2019-20 in New Format

8) Automated Form 12 BA