Section 80D

In the union budget 2018, the government of India has proposed the below changes with respect to deductions available on Health Insurance and/or towards Medical treatment. The same provisions are applicable for FY 2019-20 as well;

Health Insurance & Senior Citizens :

In Budget 2018, it has been proposed to raise the maximum tax deduction limit for senior citizens under Section 80D of the Indian Income Tax Act 1961. The limit of tax deduction allowed for FY 2017-18 for senior citizens was Rs. 30,000 which was increased to Rs 50,000, from FY 2018-19 (AY 2019-20) onwards.

- Under Section 80D an assessee, being an individual or a Hindu undivided family, can claim a deduction in respect of payments towards annual premium on the health insurance policy, preventive health check-up or medical expenditure in respect of senior citizens (above 60 years of age).

- As of FY 2017-18, only Very Senior Citizens (who are above 80 years of age), can claim a deduction of up to Rs 30,000 incurred towards the medical expenditure, in case they don’t have health insurance. Budget 2018 has increased this to Rs 50,000 and also allowed the same flexibility to senior citizens. Even individuals who pay premiums for their dependent senior citizen’s parents can claim the additional deduction on health insurance premium (or) medical expenditure.

- Single premium Health Insurance policy / Multi-year Mediclaim policy :

- In case of single premium health insurance policies having a cover of more than one year, it is proposed that the deduction shall be allowed on a proportionate basis for the number of years for which health insurance cover is provided, subject to the specified monetary limit.

The below limits are applicable for Financial Year 2019-2020 (or) Assessment Year (2020-2021) u/s 80D.

Health Insurance Premium & Section 80D Tax benefits AY 2020-21

Preventive health checkup (Medical checkups) expenses to the extent of Rs 5,000/- per family can be claimed as tax deductions. Remember, this is not over and above the individual limits as explained above. (Family includes: Self, spouse, parents and dependent children).

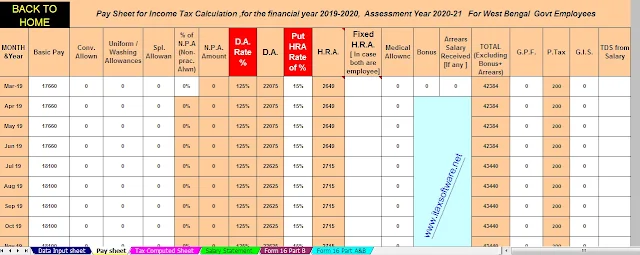

Download All in One TDS on Salary for West Bengal Govt Employees for the Financial Year 2019-2020 and Assessment Year 20120-2021 With H.R.A. Exemption Calculation U/s 10(13A) After Effect ROPA 2019

The feature of this Excel Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as per new Finance Budget 2019

2) The Salary Structure as per the All of West Bengal State employee’s Salary Pattern ( New Format as per ROPA 2019 )

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption Calculation U/s 10(13A)

6) Automated Income Tax Form 16 Part A&B for F.Y. 2019-20 in New Format

7) Automated Income Tax Form 16 Part B for the F.Y. 2019-20 in New Format