Receiving salary or pension in arrears might change your tax situation. You may fear it's going to move you up a tax

slab. Or tax rates may be higher in the year arrears are received as compared

to the year to which they belong. To protect you from any additional tax

burden, due to delay in receiving income, the tax laws allow a relief under

Section 89(1). This relief can be directly claimed in your income tax return,

if you have received any portion of your salary in arrears.

The Income Tax Department has made it

mandatory to file Form 10E if you want to claim relief under Section 89(1). As

per Section 89(1), tax relief is provided by recalculating tax for both the

years; the year in which arrears are received and the year to which the arrears

pertain. Your taxes are adjusted assuming arrears were received in the year in

which they were due.

Let's understand this calculation in

detail. Tax for the year in which arrears are received is calculated both

inclusive as well as exclusive of arrears. The difference is the tax on

additional salary, let's call it x. Now tax is computed for every year to which

the arrears pertain- including as well as excluding arrears. The difference is

arrived at, let's call it y. If x is more than y, relief is available to the

taxpayer.

Here are some important things to

remember while claiming relief on arrears:

Form 10E must be filed online on the

Income Tax Department website www.incometaxindiaefiling.gov.in.

Taxpayers who claimed relief last financial year but did not file Form 10E

received a notice from the department for non-compliance. Your return is not

processed until you submit this form.

You must submit Form 10E before filing

your income tax return.

Many taxpayers are confused about which

assessment year to choose while filing Form 10E. Arrears may pertain to earlier

years, however, one has to choose the assessment year in which arrears have

been received. For example, if arrears are received in financial year FY

2017-18, choose assessment year as AY 2018-19.

Form 10E has to be submitted online and

no copy is required to be attached with your tax return. However, you must file

and keep all documents safely in your records.

Your employer may ask for confirmation

of submission of Form 10E before adjusting your taxes and allowing tax relief.

It is not mandatory to submit this form to the employer. You can claim tax

relief by filing this form at the time of submitting your tax returns.

Salary is usually taxable when it is due

or when it actually received, whichever is earlier. Arrears are usually

announced from a back date and therefore cannot be taxed when due

Relief under Section 89(1) is also

allowed to those who receive family pension in arrears. The calculation is the

same as mentioned above. Do remember this very important step while filing your

returns if you have received arrears during the financial year.

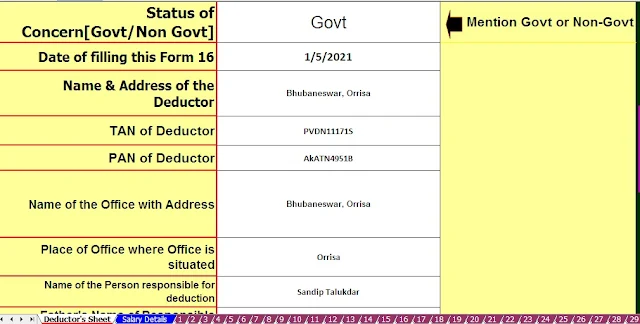

Download Automated Income Tax Master of Form16 Part B in Revised Format for the Financial Year 2019-20 [ This Excel Utility can prepare at a time 50 Employees Form 16 Part B for F.Y. 2019-20 ]