Is the Form 16 Mandatory?

Form 16 is a TDS Certificate that must be provided to employees,

by their employers. It certifies that the income tax on your income from salary

has been deducted at source, and deposited with the Central Government Account.

In other

words, Form 16 is one of the most important documents for filing your

Income Tax Returns, as it contains most of the details required for filing your

returns. Whether Form 16 is mandatory or not, is a common query that you may

have thought about. Here’s a brief lowdown to help you understand if there are

alternatives to the same.

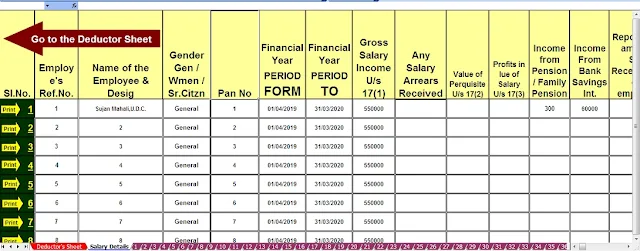

Download Automatic Income Tax Salary Certificate Revised Form16 Part B for the Financial Year 2019-20 [ This Excel The utility can prepare at a time 100 employees Form 16 Part B in Revised format]

It is mandatory for employers to provide Form 16?

Procuring Form 16 is easy, if you’re an employee. The employer

or the entity that deducts your Tax Deducted at Source (TDS) is legally bound

to issue Form 16 by May 31.

Employees with

an income of less than Rs. 2,50,000 for the Financial Year, are exempted from

income tax. However, if no tax has been deducted, Form 16 will not be

issued to them.

Why is Form 16 Required?

TDS deductors

must deposit the TDS amount on or before of 7th of every month, and file TDS

returns quarterly. Employers may fail to provide Form 16 to you if they have

not deposited the TDS or not filed the TDS returns.

In such a

scenario, you can download Form 26AS to cross-check if the employer has

deposited the TDS with the government exchequer. If you find out that your

employer hasn’t deposited the TDS, For instance, you should ask them to

do so immediately. If they have deposited the TDS, then you must be issued Form

16 at the earliest Above all,

It is always a

good practice to remind your employers about issuing your Form 16, if you don’t

receive it by mid-May.

Download Automatic Income Tax Salary Certificate Revised Form16 Part B for the Financial Year 2019-20 [ This Excel The utility can prepare at a time 50 employees Form 16 Part B in Revised Format.]

Is form 16 mandatory for ITR

The

responsibility to deduct taxes at source lies with the employer In addition,

the onus of paying tax is on the employees. If the employer fails to deposit

TDS, you must make it a point to pay your taxes immediately, so you can avoid

penalties. This amount can be claimed from your employer later.

In case your the employer has deposited the tax, but not issued Form 16 to you, After that,

you are running out of time to file your income tax

returns, you need not wait for your employer. Delays in filing your

returns can incur penalties, so you wouldn’t be eligible for any refunds on

overpaid taxes.

In such a

scenario, you need to retrieve details about your employer’s name, address, PAN

and TAN and refer to Form 26AS. The form contains details of taxes deducted and

deposited from various sources of your income. For the breakup of your salary

Similarly, you may refer to your salary slips. Also, you can compile

details or copies of all your tax-saving investments, which you may have

furnished to your employer as proof of investment. This may be a tedious task

but will help you in filing the returns on time.

In

conclusion, are you still wondering if Form 16 is mandatory? Well, if

you’re an employer, it is compulsory for you to issue Form 16 to the employee.

While you can file your ITR without Form 16, you may be required to furnish it

to the Income Tax Department in case of anomalies, or discrepancies found in

your returns. Form 16 is also important because man financial institutions or

government authorities ask for it to check your salary breakup.

Download Automatic Income Tax Salary Certificate Revised Form16 Part A&B for the Financial Year 2019-20 [This Excel The utility can prepare at a time 50 employees Form 16 Part A&B in Revised format.]