Process of Income tax calculation for the Salaried Persons for F.Y. 2020-21 As per Budget 2020

Income from salary

is the sum of Basic salary + HRA + Special Allowance + Transport Allowance +

any other allowance. Some components of your salary are exempt from tax, such

as telephone bills reimbursement, leave travel allowance. If you receive HRA

and live on rent, you can claim exemption on HRA. Calculate exempt portion of

HRA, by using this HRA Calculator.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

On top of these exemptions, a standard deduction of Rs 40,000 was introduced in budget 2018. This has been increased to Rs 50,000 in budget 2019.

In case you opt for

the new tax regime, these exemptions will not be available to you.

Let's understand

income tax calculation under the current tax slabs and new tax slabs (optional)

by way of an example. Mira receives a Basic Salary of Rs 1,00,000 per month.

HRA of Rs 50,000. Special Allowance of Rs 21,000 per month. LTA of Rs 20,000

annually. Mira pays a rent of Rs 40,000 and lives in Delhi.

Nature

|

Amount

|

Exemption/Deduction

|

Taxable(Old

regime)

|

Taxable(New

regime)

|

Basic Salary

|

12,00,000

|

-

|

12,00,000

|

12,00,000

|

HRA

|

6,00,000

|

3,60,000

|

2,40,000

|

6,00,000

|

Special Allowance

|

2,52,000

|

-

|

2,52,000

|

2,52,000

|

LTA

|

20,000

|

12,000 (bills submitted)

|

8,000

|

20,000

|

Standard Deduction

|

-

|

50,000

|

50,000

|

-

|

Gross Total Income from Salary

|

16,50,000

|

20,72,000

|

To

calculate Income tax,

include income from all sources. Include:

- Income from Salary (salary paid by your employer)

- Income from house property (add any rental income, or include interest paid on home loan)

- Income from capital gains (income from sale purchase of shares or house)

- Income from business/profession (income from freelancing or a business or profession)

- Income from other sources (saving account interest income, fixed deposit interest income, interest income from bonds)

Mira has income

from interest from savings account of Rs 8,000 and a fixed deposit interest

income of Rs 12,000 during the year. Mira has made some investments to save

income tax. PPF investment of Rs 50,000. ELSS purchase of Rs 20,000 during the

year. LIC premium of Rs 8,000. Medical insurance paid of Rs 12,000. Here are

the deductions Mira can claim under the old tax regime.

Nature

|

Maximum

Deduction

|

Eligible

investments/expenses

|

Amount claimed

by Neha

|

Section 80C

|

Rs.1,50,000

|

PPF deposit Rs 50,000, ELSS investment Rs 20,000, LIC

premium Rs 8,000. EPF deducted by employer(Neha’s contribution) = Rs 1,00,000

*12% *12 = 1,44,000

|

Rs 1,50,000

|

Section 80D

|

Rs 25,000 for self Rs 50,000 for parents

|

Medical insurance premium Rs 12,000

|

Rs 12,000

|

Section 80TTA

|

10,000

|

Savings account interest 8,000

|

Rs. 8,000

|

Nature

|

Amount

|

Total

|

Income from Salary

|

16,50,000

|

|

Income from Other Sources

|

20,000

|

|

Gross Total Income

|

16,70,000

|

|

Deductions

|

||

80C

|

1,50,000

|

|

80D

|

12,000

|

-

|

80TTA

|

8,000

|

1,70,000

|

Gross Taxable Income

|

15,00,000

|

|

Total tax on above (including cess)

|

2,73,000

|

Nature

|

Amount

|

Total

|

Income from Salary

|

20,72,000

|

|

Income from Other Sources

|

20,000

|

|

Gross Total Income

|

20,92,000

|

|

Total tax on above (including cess)

|

3,79,704

|

Up to Rs 2,50,000

|

Exempt from tax

|

0

|

Rs 2,50,000 to Rs 5,00,000

|

5% (5% of Rs 5,00,000 less Rs 2,50,000)

|

12,500

|

Rs 5,00,000 to Rs 7,50,000

|

10% (10% of Rs 7,50,000 less Rs 5,00,000)

|

25,000

|

Rs 7,50,000 to Rs 10,00,000

|

15% (15% of Rs 10,00,000 less Rs 7,50,000)

|

37,500

|

Rs 10,00,000 to Rs 12,50,000

|

20% (20% of Rs 12,50,000 less Rs 10,00,000)

|

50,000

|

Rs 12,50,000 to Rs 15,00,000

|

25% (25% of Rs 15,00,000 less Rs 12,50,000)

|

62,500

|

More than Rs Rs 15,00,000

|

30% (30% of Rs 20,92,000 less Rs 15,00,000)

|

1,77,600

|

Cess

|

4% of total tax (4% of Rs 12,500 + Rs 25,500+ Rs 37,500 +

Rs 50,000 + Rs 62,500 + Rs 1,77,600)

|

14,604

|

Total Income Tax

|

Rs 12,500 + Rs 25,500+ Rs 37,500 + Rs 50,000 + Rs

62,500 + Rs 1,77,600 + Rs 14,604

|

Rs 3,79,704

|

Individual or HUF

opting for taxation under the newly inserted section 115BAC of the Act shall

not be entitled to the following exemptions/deductions:

(i) Leave travel

concession as contained in clause (5) of section 10;

(ii) House rent

allowance as contained in clause (13A) of section 10;

(iii) Some of the

allowance as contained in clause (14) of section 10;

(iv) Allowances to

MPs/MLAs as contained in clause (17) of section 10;

(v) Allowance for

the income of minor as contained in clause (32) of section 10;

(vi) Exemption for

SEZ unit contained in section 10AA;

(vii) Standard

deduction, deduction for entertainment allowance and employment/professional

tax as contained in section 16;

(viii) Interest

under section 24 in respect of self-occupied or vacant property referred to in

sub-section (2) of section 23. (Loss under the head income from house property

for the rented house shall not be allowed to be set off under any other head

and would be allowed to be carried forward as per extant law);

(ix) Additional

deprecation under clause (iia) of sub-section (1) of section 32;

(x) Deductions

under section 32AD, 33AB, 33ABA;

(xi) Various

deduction for donation for or expenditure on scientific research contained in

sub-clause (ii) or sub-clause (iia) or sub-clause (iii) of sub-section (1) or

sub-section (2AA) of section 35;

(xii) Deduction

under section 35AD or section 35CCC;

(xiii) Deduction

from family pension under clause (iia) of section 57;

(xiv) Any deduction

under chapter VIA (like section 80C, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80E, 80EE,

80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA,

etc). However, deduction under sub-section (2) of section 80CCD (employer

contribution on account of the employee in notified pension scheme) and section

80JJAA (for new employment) can be claimed.

Following

allowances shall be allowed as notified under section 10(14) of the Act to the

Individual or HUF exercising option under the proposed section:

a) Transport

Allowance granted to a div yang employee to meet the expenditure for the purpose

of commuting between place of residence and place of duty

b) Conveyance

Allowance granted to meet the expenditure on conveyance in performance of

duties of an office;

c) Any Allowance granted

to meet the cost of travel on tour or on transfer;

d) Daily Allowance

to meet the ordinary daily charges incurred by an employee on account of

absence from his normal place of duty.

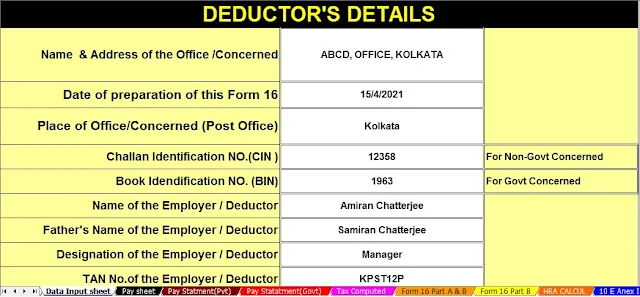

Download All in One TDS on Salary for Govt.& Non-Govt. Employees for the F.Y. 2020-21 With H.R.A. Exemption Calculation U/s 10(13A) + Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E + Automated Revised Form 16 Part B and Form 16 Part A&B for F.Y.2020-21

The feature of this Excel

Utility is the following:-

1) This Excel Utility can prepare automatic Tax Calculation as

per new Finance Budget 2020 (New Tax

Regime & Old Tax Regime, both you can calculate in the same Excel Utility)

2) The Salary Structure as per the All of Govt & Non-Govt(Private)

employee’s Salary Pattern

3) Automated Individually Salary Sheet for each Employee

4) Automated Income Tax Salary Sheet for each Employee

5) This Excel Utility calculate your House Rent Exemption

Calculation U/s 10(13A)

6) Automatic Arrears Relief Calculator U/s 89(1) with Form 10E

from F.Y. 2000-01 to F.Y. 2020-21

7) Automated Income Tax Revised Form 16 Part A&B for F.Y. 2020-21

in Excel