Excel Challan 280 FY 2019-20 AY 2020-21. Download Income Tax

payment Challan No. ITNS 280 in Excel.

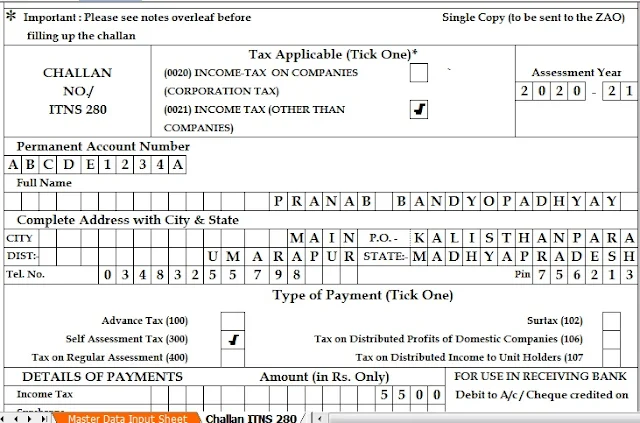

This excel Challan 280 for payment of Income Tax should be used

for making payment of income tax on companies (corporation tax) or income tax

other than companies.

Please note that Finance Act, 2013 w.e.f. 01/06/2013, had inserted Clause (aa) of Explanation to

sub-section (9) of the section 139 providing that a return of income shall be

regarded as defective unless the self-assessment tax together with interest, if

any, payable in accordance with the provisions of section 140A, has been paid

on or before the date of furnishing of return.

However, the Finance Bill 2016 has omitted the said clause (aa).

The amendment will take effect from 1st day of April, 2017 and will,

accordingly apply in relation to assessment year 2017-2018 and subsequent years.

A separate challan is required for each type of payment by placing

a tick mark at the appropriate box in the challan.

You are required to fill PAN, Assessment Year, Amount, Cheques

details (other than cash) etc.

After the challan 280 is paid to the bank, make sure that

the counterfoil contains seven digit BSR Code of the bank branch, date of

deposit and five digit challan serial number.

Sum feature of this Excel utility Are :-

1)

This

Excel Utility have tow pages (i) Details of your Pan information & Tax Due

Amount with the Financial Year (ii) Another is the main form Challan ITNS

280 which will prepared automatically after filling the details of your Pan and

others as pick up from the 1st page.

2)

No need to

write manually in this Challan Form 280 for Self / Advance Tax Payment through

any Bank

3)

Automatic

convert the Amount to the In Words in the separate Box.