CBDT clarifies process of opting concessional rates of tax, Sec 115BAC

CBDT has issued Circular C1 of 2020 dated13.04.2020. It clarifies the process of exercising of option by a taxpayer with

regard to deduction of tax at source if he/she opts for the concessional rates

of tax as per section 115BAC.

Employee to an intimate employer of the intention to opt for new concessional rates. Intimation so given will be applicable for the year

& can’t be modified. However, an employee has the right to exercise such

option or continue with the earlier scheme. He can decide it at time of filing ITR.

Circular

C 1 of 2020

F.

No. 370142/13/2020-TPL

Government

of India

Ministry

of Finance

Department

of Revenue

Central

Board of Direct Taxes

*****

New Delhi, April 13,2020

Clarification in respect of an option

under section IISBAC of the Income-tax Act, 1961

Section IISBAC of the Income-tax

Act, 1961 (the Act), inserted by the Finance Act, 2020 w.e.f. the assessment

the year 2021-22, inter alia, provides that a person, being an individual or a

Hindu undivided family having income other than income from business or

profession", may exercise the option in respect of a previous year to be taxed

under the said section IISBAC along with his return of income to be furnished

under sub-section (I) of section 139 of the Act for each year. The concessional

rate provided under section IISBAC of the Act is subject to the condition that

the total income shall be computed without specified exemption or deduction,

setoff of loss and additional depreciation.

2. Representations expressing

concern regarding tax to be deducted at source (TDS) has been received stating

that as the option is required to be exercised at the time of filing of the return,

the deductor, being an employer, would not know if the person, being an employee,

would opt for taxation under section IISBAC of the Act or not. Hence, there is

a leak of clarity regarding whether the provisions of section IlSBAC of the Act

are to be considered at the time of deducting tax.

3. In order to avoid genuinely

hardship in such cases, the Board, in the exercise of powers conferred under

section 119 of the Act, hereby clarifies that an employee, having income other than the income under the head "profit and gains of business or

profession" and intending to opt for the concessional rate under section

1iSBAC of the Act may intimate the deductor, being his employer, of such

intention for each previous year and upon such intimation, the deductor shall

compute his total income, and make TDS thereon in accordance with the provisions

of section IISBAC of the Act. If such intimation is not made by the employee,

the employer shall make TDS without considering the provision of section 11SBACof the Act.

4. It is also clarified that the

intimation so made to the deductor shall be only for the purposes of TDS during

the previous year and cannot be modified during that year. However, the

intimation would not amount to exercising an option in terms of sub-section (S) of

section J ISBAC of the Act and the person shall be required to do so along with

the return to be furnished under sub-section (J) of section 139 of the Act for

that previous year. Thus, option at the time of filing of return of income

under sub-section (J) of section J 39 of the Act could be different from the

intimation made by such employee to the employer for that previous year.

5. Further, in case of a person who

has income under the head "profit and gains of business or

profession" also, the option for taxation under section J J SBAC of the

Act once exercised for a previous year at the time of filing of return of

income under sub-section (\) of section 139 of the Act cannot be changed for

subsequent previous years except in certain circumstances.

Accordingly, the above

clarification would apply to such person with a modification that the

intimation to the employer in his case for subsequent previous years must not

deviate from the option under section IISBAC of the Act once exercised in a

previous year.

(Niraj

Kumar)

Deputy

Secretary (TPL)-I

Copy to the:

I. PSI OSD to FM/ PS/OSD to MoS(F).

2. PS to the Finance Secretary.

3. Chairman and Members, CBDT.

4. Joint Secretaries/ CsIT/

Directors/ Deputy Secretaries/ Under Secretaries, CBDT.

5. C&AO of India (30 copies).

6. JS & Legal Adviser, Ministry

of Law & Justice. New Delhi.

7. Institute

of Chartered Accountants of India.

8. CIT (M&TP). Official

Spokesperson of CBD.

9. Principal DOlT (Systems) for

uploading on the official website

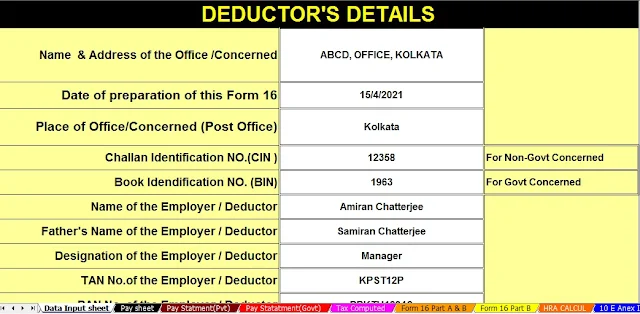

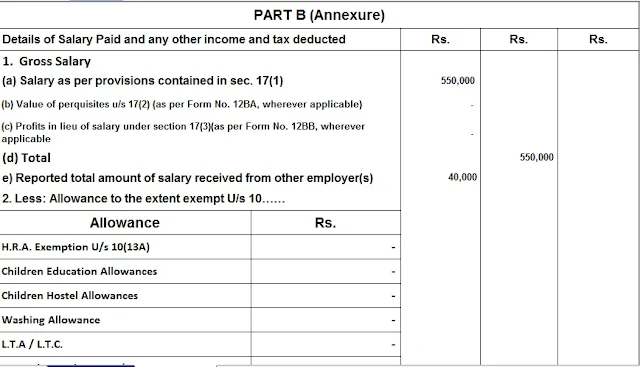

Main Feature of this Excel Utility:-

$ This Excel The utility can use Government and Private Concerns Employees U/s 115BAC

$ This Excel The utility has the Individual Salary Structure as per the Government and Private

Concern’s Salary Structure both can use

$ This Excel The utility has all the Amended Income Tax Section as per Budget 2020

$ This Excel

Utility prepares automated Tax Calculation as per Section 115BAC as New and Old

Tax Regime.

$ This Excel

the utility can prepare automated Revised Form 16 Part B

$ This Excel The utility can prepare automated Revised Form 16 Part A&B

$ This Excel

Utility Prepare automated Arrears Relief Calculator U/s 89(1) with Form 10E

from the F.Y.2000-01 to F.Y.2020-21

$ This Excel

Utility automated calculate House Rent Exemption Calculation U/s 10(13A)

$ Automatic

Convert the Amount into the In-Words without any Excel Formula.