The Finance Minister mentioned in his 2020 budget speech that he had simplified the income tax structure. Unfortunately, this is far from the truth. What has happened is that the budget has given you another option to calculate your taxes. More options mean more complexity.

We have come up with an income tax calculator that incorporates both existing systems and new tax systems. You can fill in the details and find out which one works best for you.

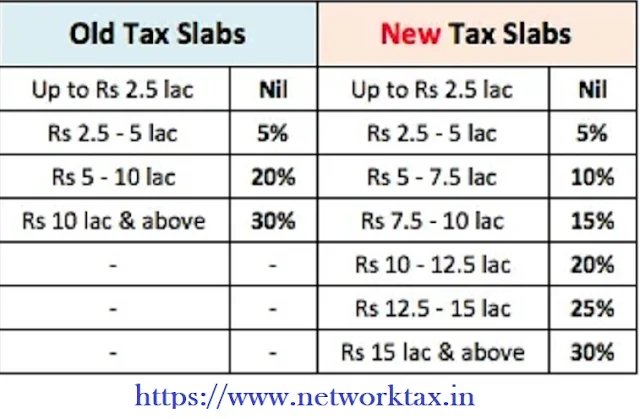

Picture of New Tax Slab

If you want to opt for the new tax regime, you will need to get most of the tax deductions and exemptions such as StandardDiscount, Chapter VI Exemption, HRA Benefit, LTA, Home Loan Interest for Self Occupied Homes etc.

In most cases, with the new tax system, in the case of tax exemptions, the taxes start to become higher.

Income Tax Slab for FY 2020-21 (AY 2021-22) (New Method)

Existing tax regime tax slab

If you follow the existing tax system, there is no change in the tax slabs.

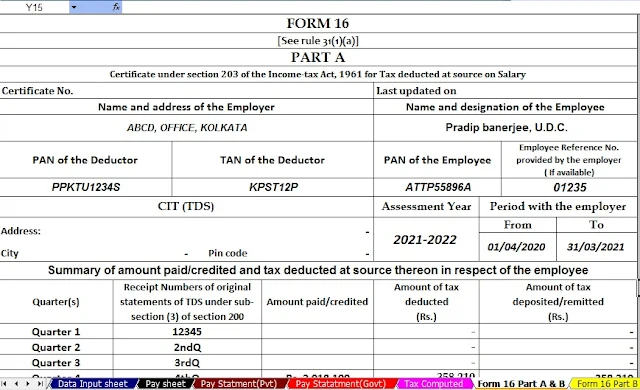

[This Excel The utility can prepare at a time Income Tax Computed Sheet + Individual SalaryStructure as per the Govt and Private Salary Pattern+ Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 + Automated Income Tax Revised Form 16 Part A&B and Revised Form 16 Part B in new format ]