Did you know that

under the new tax code, no discounts or rebates are allowed? Let's take a look

at the new tax system - follow the list of exemptions and exemptions in detail.

Therefore, During 2020

budget, the finance minister introduced a new tax regime.

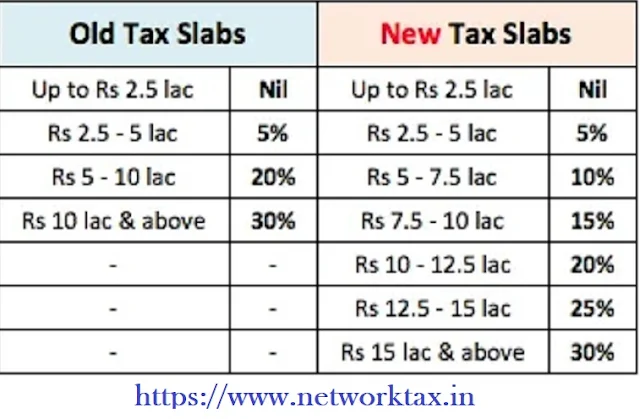

New Income Tax Slab is given below

In other words, there is an option

to pay lower taxes if you meet certain conditions. One such condition is that

you are not eligible for certain discounts and rebates. The following new tax system tax slab applies: - A figure of tax slab for 21-22 New tax system - full

list of exemptions and rebates not approved. However, now look at the

exemptions and concessions not allowed under Sec.15 BAC,

1. Discount the

applicable Travel Discount (LTC) for salaried employees

2. Home Rent

Allowance (HRA) applicable to salaried employees

3. For instance,

Standard discounts cannot be claimed for individuals in employment as opposed

to salary income when the taxpayer opts for 114 BAC.

4. Entertainment

allowance and professional tax exemption.

5. Life Insurance

Premium, SIM Payable for Delayed Annual Plan, EPF, PPF, Supervision Scheme,

SSY, NSC, ELSS Mutual Fund, Tuition Fee, Principal Payment for your Home Loan,

Discount on Tax Savings, FS, etc. Contributions by Central Government employees

to NPS Tier 2, by you under NPS Contribution (Sec.80 CCD (1) and Sec. 80 CCD(1B).

Above all, under Sec. CCD (2)

Will continue. Sec. Exemption under Section 80D-the amount paid by LIC or other

insurers to an individual or HUF (in any mode other than cash) is effective or

the application of any insurance for the health of a particular person.

Section. Section 80 DD - A person with a disability is exempt from maintenance,

including the treatment of a dependent. .

6. Section 80E -

Amount of taxable income paid by paying interest on loan taken from financial

institution / approved charity for higher education. The interest payable for

100

7. Section 80EE -

For the purpose of acquiring residential house property for which the amount

does not exceed Rs. 2,000, Rs. 35 lakhs and Rs. 50 lakhs by the taxpayer from any approved financial institution during the financial year 2011-17-1. 11.

8. Section 80 EEA -

Interest paid on loan taken by a person from any financial institution from

01/04/2019 to 31/03/2010 is not appropriate to claim a rebate from any

financial institution under section 80EA.? Acquisition of residential

property, valued at Rs. 45 lakh 12.

10. Section 80EEB -

Interest is payable on loan taken by a person from a financial institution at

the time After that, 31/03/2023 for

purchase of electric vehicle starting from 01/04/2019.

11. Similarly,

Section 80 GG - Rent for furnished / unfinished residential accommodation

(subject to certain conditions).

12. Section 80G -

Exemption in case of grants to certain funds, charities etc.

13. Section 80 GGA

- Exemption for specific grants for scientific research or rural development

14. Section 80GGC-

Exemption in case of a contribution made by any person to political parties

15. Section 80 JJA

- Exemption from Profit and Profit from Bio-Degradable Waste Collection and

Processing Business 18.

16. Section 80QQB-

Royalty income of authors of books of certain categories other than textbooks.

17. Royalty in

respect of patents (subject to certain conditions) on or before 01.04.2003

under section 80RRB

18. Section 80 TTA

- Interest on Deposits in Savings Accounts of Banking Agencies, a Post Office,

Co-operative Societies Engaged in Banking Business etc. (subject to certain

conditions)

19. Section 80 TTB

- for senior citizens - interest on deposits (subject to certain conditions) on

any banking institution, a post office, cooperatives engaged in banking

business, etc. - for senior citizens

20. Section 80U- A

a resident who is certified to be a disabled person by the medical authorities at

any time during the previous year.

21. Article 24 (b)

- In case of private taxpayers who have the self-occupied property for their own

residence or cannot occupy any property due to employment, business or

occupation, they should keep it in a building owned by them in another place,

the annual value of the property. Will be taken as 'zero'. However, the interest

on the loan is up to a maximum of Rs 2 lakh.

22. Allowance

(under section 10 (14)) such as travel/transfer allowance, transport

allowance, support allowance, research allowance or uniform allowance

23. Any allowance

paid to meet the expenses of an assistant appointed to perform such office

duties or for-profit employment; 2. Any allowance paid for incentives for

academic, research and training in educational and research institutions

Any allowance paid

to cover the cost of purchase or maintenance of uniforms to be worn during

office duties or for-profit work.

24. [Special

Compensation (Healy Area) Allowance] or High Allowance Allowance or

Unreasonable Climate Allowance or Snow Limit Area Allowance or Any Special

Compensation Allowance in nature of Snowfall Allowance

25. Border Area

Allowance, Remote Local Allowance or Complex Area Allowance or Troubled Area

Allowance Any special compensation allowance in nature

26. Special

Compensation (Tribal Areas / Scheduled Areas / Agency Areas) Allowance

27. Any allowance

paid to an employee working in any transport system to cover his personal

expenses while transporting from one place to another if such employee does not

receive a daily allowance.

29. Any allowance

given to an employee to cover his child's hostel expenses

30. Field allowance

in the field of compensation

31. Compensatory

field allowance 3

Any special

allowance of nature as anti-rebellion allowance of the members of the active

forces in the area away from the permanent position of the members of the

terrorist forces.

32. Underground

allowance is paid to employees working in abnormal, unnatural climates in

underground mines.

33. Any special

allowance of high altitude (unreasonable climate) nature to a member of the

armed forces working in high altitude areas

34. Special

Compensation To provide any special allowance to the members of the Armed

Forces as field allowance for the highly active field

35. In

conclusion, any special

allowance paid to a member of the armed forces in the nature of the island

(duty) Section 40 (1) - In case of a Member of Parliament or a member of any

State Legislative Assembly or any Committee, no income shall be deductible by

payment of a daily allowance or any allowance, when this person elects for

Section 114 BAC. 42. Section 10 (32) - In case, under section 644 (1A), the

the income of the parents of the minors has been consolidated, deducting Rs. 1,500

as per the merits of section 10 (32). This waiver cannot be claimed by parents

who opt for Section 115BAC.

36. The standard

waiver applicable to individuals in the case of employment as opposed to salary

income cannot be claimed when the taxpayer opts for 114 BAC.

37. Entertainment allowance and professional

tax exemption. List of tax exemptions and allowances imposed on new taxes

(Section 114 BAC) Values approved under Sec.111 BAC are as follows: - Residence

A Diving employee is paid a transport allowance to cover the cost of travel

between the place of residence and the place of responsibility. Office

Allowance to meet the expenses incurred in carrying out the duties of an

office;

38.Tour Any

allowance paid to cover the cost of travel or relocation. Paying daily

allowance due to the absence of an employee from his / her normal place of

responsibility. Below is a list of exemptions allowed under the new tax rate:

1. Retirement

benefits, gratuity etc.

2. Transportation

of pensions

3. Leave encryption

at leisure

4. Return

compensation

5. VRS facility E.

EPFO: Employer's Contribution N. NPS withdrawal facility. Scholarship

6. Awarding prizes

established in the public interest

Feature of this Excel Utility:-

1)

The Tax The calculation will be made as per the new section 115BAC as per Budget 2020 ( New

and Old Tax Regime) [

After filling the Salary Sheet]

2)

This

Excel Utility can prepare Automatic your Income Tax Calculation Sheet [ After filling the Salary Sheet]

3)

This

Excel utility can prepare automatic Individual Salary Sheet [ After filling the Salary Sheet]

4)

This

Excel Utility can prepare Automatic House Rent Exemption Calculation U/s

10(113A) [

After filling the Salary Sheet]

5)

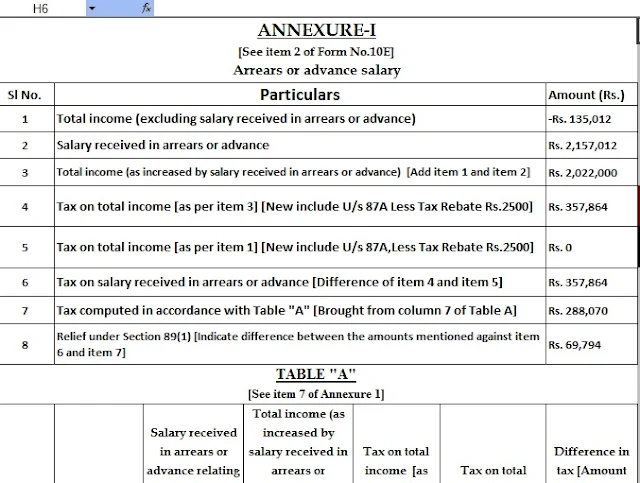

This

Excel Utility Prepare automatic Arrears Relief Calculation U/s 89(1) with Form

10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version) [ After filling the Salary Sheet]

6)

This

Excel Utility have the Salary Structure as per the Govt and all Private

Concerns Salary Pattern

7)

This

Excel Utility can prepare automatic your Income Tax Revised Form 16 Part

A&B [

After filling the Salary Sheet]

8)

This

Excel Utility can prepare automatic your Income Tax Revised Form 16 Part B [ After filling the Salary Sheet]

9)

Automatic

Converted the Amount into the In-Words without any Excel Formula

10)This Excel Utility can use Govt and Non-Govt(Private Concern both.

11) Easy to install just like an Excel File and Easy to Generate