The minister of finance remarked in Indian Budget 2020 that she had

simplified the income tax structure. Unfortunately, this is far from the truth.

What has happened is that the budget has given you another option to calculate

your taxes. More options mean more complexity.

We have come up with an income tax calculator that incorporates both the

existing system and the new tax system. You can fill in the details and find

out which one works best for you

If you want to choose the new tax discipline, you will need to waive most of the tax exemptions and exemptions such as standard exemption, Chapter VI exemption, HRA benefits, LTA, home loan interest for self-occupied home etc.

In most cases, with the new tax system having tax breaks, the taxes will be higher

New Tax Regime – Tax Slabs

New Tax Regime – Tax Slab for the F.Y.2020-21

Feature of this Excel Utility:-

1. This Excel utility

Calculate your Tax Liability U/s 115BAC ( New and Old Tax Regime) as per your

option.

2. This Excel utility have

the Salary Structure as per the Non-Government (Private) Salary Pattern

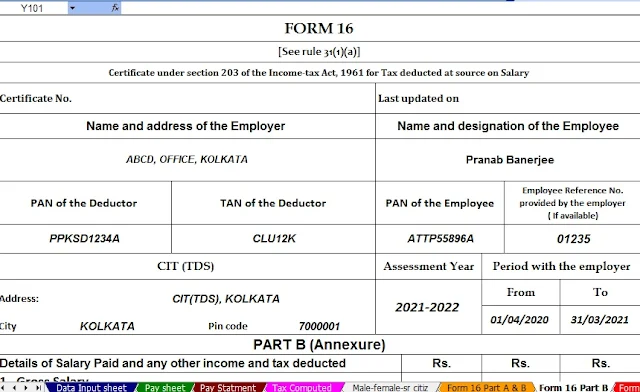

3 This Excel Utility

prepare automatic Revised Form 16 Part A&B in a new format

4 This Excel utility

prepare automatic Revised Form 16 Part B in a new format

5. Automated Income TaxForm 12 BA

6. This Excel Utility

calculate your House Rent Exemption Calculation U/s 10(13A)

7. Individual Salary Sheet

8. Individual Tax Computed

Sheet

9. In this Excel Utility

have all the Income Tax modified Section as per Budget 2020