The deposition of advance taxes seen a reduction to reduce decline resulting in more than 30% reduction in the

Gross Tax Collections. The dip shows that the businesses have been impacted

very harshly by the coronavirus lockdown.

All the companies and other

“big” assesses are required to pay an advance tax

to the government. The tax is to be paid in four instalments every quarter.

The obligations of the first quarter are to be paid by 15th June. the officials

have not made a clear statement on the collections as the assesses are still

submitting the tax, but the collections received until now show that there has

been a reduction in collection of tax for the first quarter and there is

distress among the business owners.

The revenue of the central government, as well as the states, has reduced as states share 45% of the total

collections under this head. The dip in the collection is similar to that seen

in the GST collections for April and May, which

are estimated to be at least 45% short of the average collection.

DownloadAutomated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10 E from the F.Y.2000-01 to the F.Y.2020-21 (Updated Version) You can calculate the same through the Income Tax Department Website just Click this Link

The government had estimated

that there will 13% increase in the direct tax collections in the new financial

year, while the overall tax revenue was estimated to be 12% higher but the

first quarter has shown that the gross advance tax collections have been

slumped by 79%. The personal income tax is also estimated to be at least 64%

lower than the average. The full picture of the collection and revenue should

be clearing in one or two days.

The lockdown has disrupted the

overall activity of the economy resulting in a massive decline in revenue of

the government from all sources. Although the businesses have started their

operations after two months of lockdown, they are not working at their full

capacity. The big oil companies have seen pressure as a huge quantity of crude

oil has been stocked, which was purchased at higher prices, but the decline in

demand has forced them to stock.

The reduction in revenue will

force the government to make some cut-backs in the spending. The target of 3.5%

growth in Gross Domestic Product also looks far fetched due to the contraction

in the economic activities.

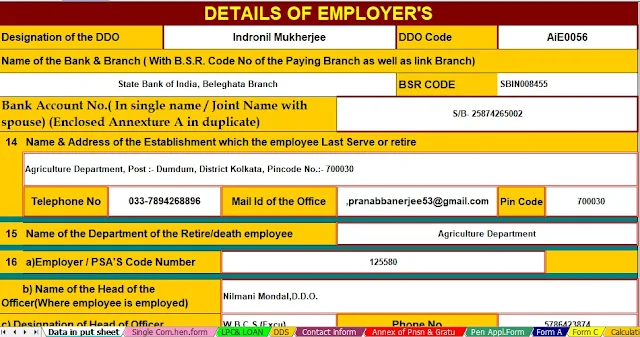

1) Autofill and AutoCalculate all Pension of the W.B.Govt Employees.

2) Automatic

Calculation the Pension Amount as per the Service Length of the retired

employees as per the ROPA 2019

3) Automatic

Calculation Gratuity Amount as per ROPA 2019

4) Automatic Calculate

the actual service Length after filling the employee’s Date of Joining and Date

of Retirement.

5) Automatic fill the

all pension related Papers as desired by the A.G. (W.B.)

7) Automatic Prepare

the Pension Calculation Revised Single Comprehensive Form

8) If any discrepancy arises

this Excel Utility, please intimate me through the mail, so I can remove the

problem.