House Rent Allowance (HRA) is generally considered as

a part of the salaried persons and is generally added in the salary structure to

help the individual to save taxes. House rent allowance conclusion is given

under section 10(13A) of the Personal Tax Act as per Rule 2A of the Annual Tax

Rules.

In the event that you stay in a rented house

and get a HRA from your employer then you can claim partial exemption of House

Rent Allowance on meeting the prescribed conditions:

1. What are the conditions to claim the House Rent

Allowance(HRA) Derivation? The worker must satisfy the accompanying conditions

to claim House Rent Allowance finding: The allowance must be specifically

granted to the representative by his employer to meet expenditure actually

incurred on payment of rent in respect of residential house involved by the

assessee. The representative should not be the owner of the residential house

involved by him. The worker must have actually incurred expenditure on payment

of rent. It is necessary to have a relation of the representative and the

employer.

2. Amount of Exemption in respect of House Rent Allowance is regulated by the rule2A. The least of coming up next is excluded from tax:

2. Amount of Exemption in respect of House Rent Allowance is regulated by the rule2A. The least of coming up next is excluded from tax:

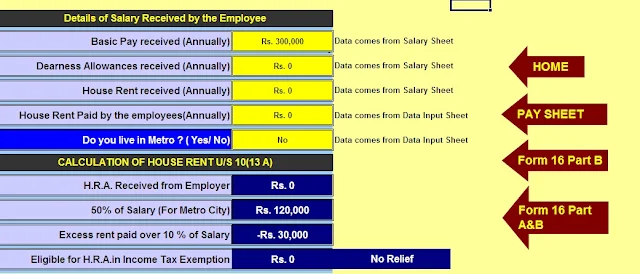

Major Urban areas Mumbai, Delhi, Calcutta, Chennai Other Urban communities Allowance received Rent paid more than 10 per penny of salary 50 per penny of salary Allowance received Rent paid more than 10 per penny of salary 40 per penny of salary

Download Automated IncomeTax Revised Form 16 Part B for the Financial Year 2019-20 and Assessment Year2020-21 [ This Excel Utility can prepare at a time 50

Employees Form 16 Part B]

3. How to calculate House Rent Allowance(HRA)? For registering HRA, salary

means basic salary and incorporates dearness allowance, if the terms of work so

provide. Salary shall exclude other allowances and perquisites.

Example: Mr A, who resides in Chennai, gets Rs. 6, 00,000 as a basic salary. He receives Rs. 1, 70,000 as house rent allowance (HRA). Rent paid by him is Rs. 1, 80,000. Discover the amount of exemption of house rent allowance.

Arrangement: The exemption will be worked out as

follows: House rent allowance received for the year Rs. 1,70,000 half of salary

Rs. 3,00,000 Rent paid less 10% of salary Rs. 1,20,000

HRA Calculator You can also register your HRA via

this House Rent Allowance Calculator available on the official site of the

Personal Tax Department From the Below Link

Or view your H.R.A. Exemption Amount by the below

given Excel Based Software which can calculate your House Rent Exemption Amount

as per Income Tax Act U/s 10(13A)

Truly,

you can claim HRA exemption. The main condition is that the rent should be paid

to the spouse on a monthly basis. There is no legal requirement yet in such

case rent should be paid through bank transfer. You have to prove that it was

paid.

Download Automated IncomeTax Revised Form 16 Part B for the Financial Year 2019-20 and Assessment Year2020-21 [ This Excel Utility can prepare at a time 100

Employees Form 16 Part B]

HRA finding and Housing Loan Advantage 5. Can I claim

house rent allowance exemption and housing loan exemption simultaneously? In

the event that truly, then how? House rent allowance covered under section

10(13A) and housing loan exemption covered under section 24(1).

These

are two different sections. Anyone can claim both advantages simultaneously.

Assume, Mr. A lives in Delhi

however because of work went to Mumbai. He gets house rent allowance from his

employer and paid the rent to the landlord. He has his own house in Delhi and his family live

in the house. He has taken a home loan on his own house..

New Tax Regime 7. Can I claim house rent allowance under the new tax regime which is applicable from the assessment year 2021-22? No, under new tax regime you are not allowed to claim house rent allowance. 8. Is mandatory to adopt new tax regime? No, it's not mandatory to adopt a new tax regime. It relies upon the individual as per the New Section 115 BAC for the F.Y.2020-21

New Tax Regime 7. Can I claim house rent allowance under the new tax regime which is applicable from the assessment year 2021-22? No, under new tax regime you are not allowed to claim house rent allowance. 8. Is mandatory to adopt new tax regime? No, it's not mandatory to adopt a new tax regime. It relies upon the individual as per the New Section 115 BAC for the F.Y.2020-21