Possessing a home can be considered as one of the most desirable wishes for the greater part of us. In any case, given the soaring costs of houses in the metros and even in Level II urban communities, it has become increasingly hard for individuals to afford it.

Therefore, the administration

has concocted several key benefits under section 24(B) of the Personal Tax Act,

1961 to grant help by way of various tax breaks for purchasing a house as a way

of rewarding anyone who puts resources into real estate.

This article covers all the provisions under Sec 24( B) that assist you with bringing down your tax liability as a buyer.

What is The Exemption That Can be claimed Under Home Loan?

There are certain deductions you can claim and get and decrease your tax outgo on the off chance that you have salary from house property.

1. Standard Deduction

The standard deduction rate of 30% is applicable on the Net Yearly Expense of the property. The best part about this deduction is that it is allowed in any event, when the actual consumption on the property is sequential.

The normal costs that may be caused may be insurance, repairs, power, water gracefully, and so forth. An important highlight remember here is that as the Annual Value of a self-involved house is nil, the standard deduction applicable is also nil.

2. Exemption On The Interest Part Of The Home Loan Restrictions.

As a homeowner, you can claim a deduction up to INR 2 lakh on the interest of your home loan in the event that you are self involving the house. You can also claim this deduction if your home is vacant. In any case, in case you have let out your property, the whole interest on the home loan can be claimed as a deduction.

In any case, there are certain criteria you should meet else the deduction on interest will be restricted to Rs 30,000:-

• The house loan taken should only be for the purchase and construction of the house;

• The loan must be taken on or after first April 1999;

• The purchase or the construction, whichever be the case for which the home loan is undertaken ought to be finished inside 5 years from the finish of the financial year in which the loan was taken

Apart from the conditions mentioned above, you ought to remember that an interest certificate is an unquestionable requirement for claiming a deduction for the interest payable.

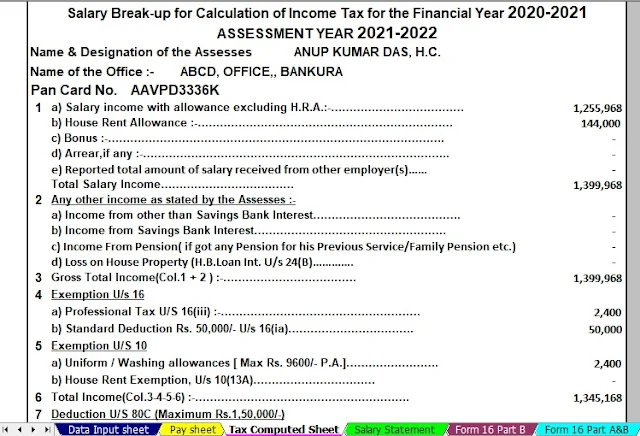

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

4) Individual Salary Structure as per the West Bengal Govt. Employees Salary Pattern as per ROPA-2019

5) Individual Salary Sheet

6) Individual Tax Computed Sheet

7) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

8) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount in to the in-words without any Excel Formula