Those opting for new tax regime from the monetary year 2020-21 onward should present an additional Form 10-IE while presenting their income tax returns.

The (CBDT) notified a new Form to be filled by those opting for the new or old tax regimefor the financial year 2020-21. This new Form notified by CBDT on 1st October 2020 is Form 10-IE.

You should document this Form at the hour of filling your income tax return (ITR) on the off chance that the taxpayer has picked the new or old tax regime U/s 115 BAC.

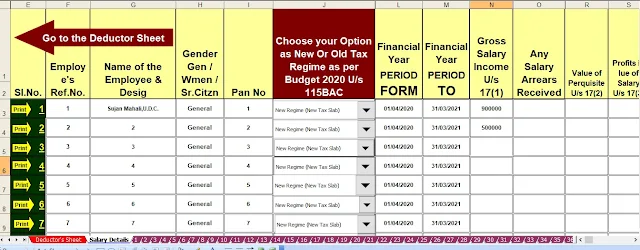

[This Excel Utility prepare at a time your Income Tax as per your option U/s 115BAC perfectly + Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version) + Automated Calculation Income Tax House Rent Exemption U/s 10(13A) + Individual Salary Structure as per the Gov and Private Concern’s Salary Pattern + Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 + Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21]

Finance Minister Nirmala Sitharaman Introduced the new tax regime in the Budget 2020 . The new tax regime is discretionary, anybody opting for it needed to forego a large portion of the deductions accessible under the income tax law, for example, Section 80C, 80D, 80TTA for a deduction on investment account of any Bank or Post Office. The new tax regime, be that as it may, offers concessional tax rates.

A taxpayer is needed to decide on the new or old tax regime at the time of filling the ITR, according to newly-introduced Section 115BAC of the Income Tax Act, 1961. This will be done through the new Form 10-IE notified by CBDT.

Taxpayers need to take care of the Form 10-IE to pass on to the tax authorities that a new tax regime has been decided to filling their ITRs. As per the tax laws, any person who has business income will present the Form 10-IE before the due date of filling of the ITR on July 31 or sometime in the future in the time that the cutoff time is reached out by the public authority. Salaried people can fill this Form 10-IE e previously or/at the time of submit their option U/s 115 BAC in due time.

[This Excel Utility prepare at a time your Income Tax as per your option U/s 115BAC perfectly + Automated Income Tax Form 12 BA + Automated Calculation Income Tax House Rent Exemption U/s 10(13A) + Individual Salary Structure as per the Private Concern’s Salary Pattern + Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21 + Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21]