In this article discuss about Income Tax Exemption for the F.Y.2020-21 as per U/s 115 BAC| Since the Financial Year 19-20 has approached its conclusion, the books of accounts should be shut| So everybody should look for on guidance from their expense experts for charge saving choices as your earlier year's income will be burdened in the current F.Y 20-21 or A.Y. 20-21| Also It is noted that the all of the benefits can be entitle to the tax payers who are opting the Old Tax Regime U/s 115 BAC|

Since the Coronavirus flare-up has been an obstruction to large numbers of our financial challenges, here are some straightforward and fast tips that might want to share| Beginning with the first:-

1. Section 80C deductions well, it's a bundle of different qualified deductions that one is searching for. It includes various alternatives like LIC, PPF(Public Fortunate Asset), Suknaya Samridhi Account, Shared assets, Fixed Deposit and so on In any case, before that, it might want to clarify what is the deduction? A deduction is something which reduced the taxable income. The assessment is determined on the net taxable income which is gotten by deducting the gross total income with this deduction.

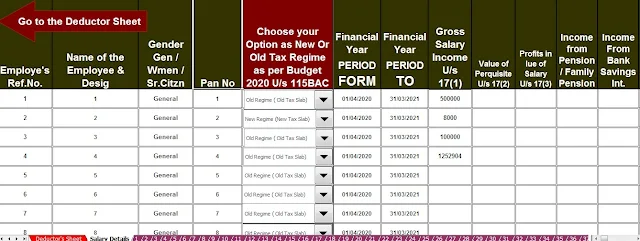

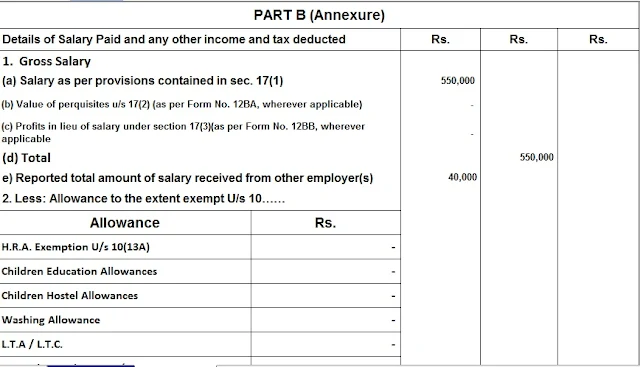

You may also like:- Automated Income Tax Preparation Excel Based Software All in One for the Government and Private Employees for the F|Y2020-21[This Excel Utility can prepare at a time Income Tax Compute Sheet + Individual Salary Structure + Automated H.R.A. Calculation U/s 10(13A) + Automated Income Tax Arrears Relief Calculation U/s 89(1) with Form 10E + Automated Income Tax Revised Form 16 Part A&B and Form 16 Part B as per the new and old tax regime U/s 115 BAC]

2. Section 80CCC this is only your annuity reserves. You can claim this deduction by adding to any benefits plans.

3. Section 80CCD(1) all things considered, this deduction deals with interest in Atal Annuity Yojana and commitment towards Public Benefits Plan. Atal Annuity Yojana is a retirement arranged plan which turns out ordinary revenue to investors after their retirement. This section applies to both independently employed and salaried individuals. In the section that you are a salaried representative, at that point, you can claim the greatest deduction of 10% of your salary which incorporates basic salary and dearness allowances| In the event that you are an independently employed individual, at that point, you can claim a deduction up to 20% of your gross salary for example basic salary and dearness allowances | There's likewise extra section 80ccd1 (b), which gives you an extra tax deduction of Rs.50,000 for invest to NPS account|

4. Section 80CCD (2) this section deals with the invest to NPS account by the business | Other than adding to the EPF account as we had seen before in section 80C, the business can add to the NPS account of his/her employees too | Under this, the promise by the business would be as per the following:-

14% of salary if there should arise an occurrence of the Government representative (whichever is lower) and 10% of salary in the event of others(whichever is lower)|

5. Section 80D, 80 DD, 80 DDB These sections especially deals with health protection charge and health consumption (upto Rs. 1,00,000), Health treatment of a ward with disability (Typical Disability :Rs. 75,000/ - , Extreme Disability: Rs. 1,25,000) and determined sicknesses (senior citizens: upto Rs. 1,00,000 Others: upto Rs. 40,000) respectively|

You may also like: - Automated Income Tax Revised Form 16 Part A&B for the F|Y 2020-21[This Excel Utility prepare at a time 50 Employees Form 16 Part A&B as per the new and old tax regime U/s 115 BAC]

6. Section 80E, 80EE,&80EEA these sections deals with the interest installments towards advanced education loan, Home loan, first time home buyers individually| The deduction under section 80 E can be claimed exclusively after loan reimbursement begins| Highlight be noted is that a person reimbursing the loan can just claim the deduction under this section| There's no most extreme or least deduction limit|

Section 80EE deals with interest on lodging loan with a deduction up to Rs. 50,000 subject to certain conditions| Exemption U/s 80EEA interest on home loan for first time home purchaser| While section 24(B) permits interest deduction of Rs.2,00,000, section 80EEA permits extra deduction of Rs.1,50,000 to home buyers.

7. Section 80G, 80GG, these sections is identified with gifts| Gifts surpassing Rs. 10,000 ought not to be made in real money| Section 80 GG is for house rent paid| You can claim this deduction just on the off chance that you don't benefit HRA from your employer, if there should be an occurrence of salaried employees| The measure of deduction can be the least of the accompanying 3 conditions:-

a) Rs.5000 p.m. Or then again Rs.60,000 yearly.

b) 25% of total income

c) Sum acquired in the wake of deducting 10% of income from the sum paid as rent in the particular F|Y.

8. Section 80TTA and 80 TTB It's about interest acquired on the bank account and on Fixed Deposit separately| The interest deduction for a bank account is permitted simply up to Rs. 10,000 above which it will be taxable| 80TTB is valuable to senior residents (60 years or more) deduction is permitted up to Rs.50,000 past which it is taxable|

9. Section 80U this is for those taxpayers who are physically disabled| Typical disability, a deduction up to 75,000/ -, Extreme Disability, a deduction upto 1,25,000 permitted.

Conclusion: All the deductions under section 80C ought not to surpass the total furthest reaches of 1,50,000 for claiming of deduction| The standard deduction for the salaried class has been expanded from Rs. 40,000 to 50,000|

Download Automated Income Tax Revised Form 16 Part A&B for

the F|Y 2020-21[This Excel Utility

prepare at a time 100 Employees Form 16 Part A&B as per the new and old tax

regime U/s 115 BAC]