Before explain the deduction of 80C, you know about the new Income Tax Section 115 BAC which introduced in Budget 2020. You have to give an option through new Option Form 10-IE as you are willing to Opt-in as New Tax Regime or Opt-in as Old Tax Regime. If you opt-in as New Tax Regime (New Tax Slab), then you can not avail any Income Tax benefits except NPS. But if you opt-in as Old Tax Regime then you can get all the Income Tax benefits as per Income Tax Act.

Let us look at

what section 80 C of the Income Tax Act 1961 is, according to the tax laws, you

can claim a deduction of Rs. 1.5 lakh from the total income under Section 80C

basically you can reduce up to Rs 1.5 lakh from the total taxable income by saving

and investing money in the particulars that are listed under Section 80C

towards tax benefits.

This benefit under Section 80C can be availed by individual taxpayers and the Hindu undivided family. Having understood this far. Let us know as to how exactly you could benefit from section 80C, and utilize the exemption Rs. 1.5 lakh that you can.

Download Automated Income Tax Revised Form 16 Part A&B and

Part B for the Financial Year 2020-21 as per new section 115 BAC[This Excel Utility Prepare one by one Form 16 Part A&B

and Part B]

As mentioned

before, you need to deploy this sum into particulars that are listed as tax savers under Section 80C, and they are many such items. Actually, there are

over a dozen avenues through which taxpayers can use to exhaust their tax

savings under Section 80C. Each of these items is unique.

Though they all have a common objective, which provides for tax savings on the monies that flow into them each financial year. Let us know the main features of each one of Section 80C.

Download Automated Income Tax Revised Form 16 Part B for the Financial Year 2020-21 as per new section 115 BAC [This Excel Utility Prepare one by one Form 16 Part B]

Public provident

fund the public provident fund (PPF) is one of the oldest tax saving item in

the country, which was introduced in 1968. It is a long term retirement savings

option, which functions like savings, come tax savings medium, the PPF has a

minimum tenure of 15 years, which can be extended in blocks of five years as

per your wish. The amount deposited during a financial year in the account can

be claimed under Section 80C deductions within the 1.5 lakh limit.

Employee’s provident fund (EPF) your contributions in EPF are eligible for tax deductions of up to Rs.1.5 lakh under Section 80C, and the money that you accumulate new Annual Pension Scheme (APS) on the guaranteed interest which is notified at the beginning of the financial year. We provide flexibility to taxpayers. They can withdraw from the account. After the mandatory specified period of five years, like PPF the gains from EPF are also tax-free.

Download Automated Income

Tax Revised Form 16 Part A&B for the Financial Year 2020-21 as per new

section 115 BAC [This Excel Utility

Prepare at a time 50 Employees Form 16 Part A&B]

National Savings

Certificate or NSC, the NSC is a guaranteed income investment scheme that you

can open at any post office, the tenure for the scheme is fixed at five years,

and the interest rate is guaranteed under the current interest rate on NSC. However,

the gains from the NSC returns are taxable as they're added to your income.

Sukanya samriddhi yojana, this scheme is designed to provide a bright future for the

girl child, the SSY account can be opened at the post office and recognised

banks. the account can be opened before she turns 10 years old, the interest

rate offered on this account is guaranteed. The interest earned in this account

is tax-free.

Five years of tax savings fixed deposit scheme. This is bank deposits for a five-year term, in which the savings upto Rs. 1.5 lakh in a financial year qualify for a tax deduction under Section 80C. However, like the NSC gains from this deposit are taxable as they're added to your income.

Download Automated Income Tax Revised Form 16 Part A&B for the Financial Year 2020-21 as per new section 115 BAC [This Excel Utility Prepare at a time 100 Employees Form 16 Part A&B]

Senior citizen

savings scheme to address the tax-saving needs of senior citizens, the SC SS

was introduced by the government for those who are 60 years old or more, when

the deposit money will mature after five years from the date of account

opening, but can be extended once by an additional three years. In this scheme,

the returns are guaranteed.

Equity-linked

savings scheme. The (E l SS) is an equity mutual fund category in which

investments qualify for tax deductions under Section 80C up to Rs.1.5 lakh in a

financial year. The LSS is a market-linked product and doesn't guarantee any

returns and comes with a three-year lock-in, which is the shortest among the

tax savings options under Section 80C as the LSS is a mutual fund. There is a

convenience to start a SIP with the LSS to make tax savings, a regular exercise

with just 12,500 rupees SIP each month.

National Pension

System, or NPS the NPS is a voluntary retirement scheme, through which you can

create a retirement corpus or your old age pension and available to all Indian

citizens above 60 Years old. The investments under tier one of the NPS qualify

for tax deductions under Section 80 C up

to Rs.1.5 lakh in a financial year, there is an added advantage of saving

additional tax with the NPS

Another New NPS U/s 80CCD(1B) subscribers can claim an additional deduction for investments of 250 1000 rupees in a financial year under Section 80 CCD(1B), which is over and above 1.5 lakh rupees deduction under Section 80C, the gains from the NPS investments, as well as the final corpus are fully tax-free.

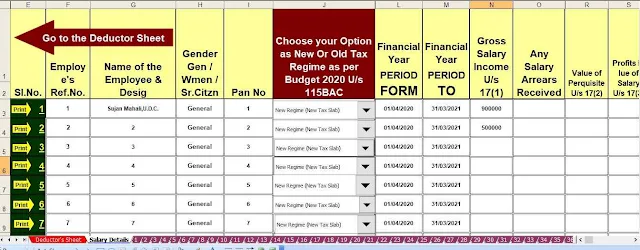

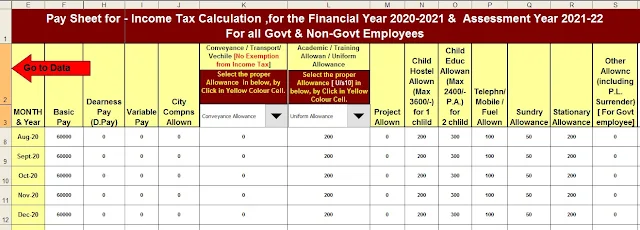

Feature of this Excel Utility:-

1) This

Excel utility prepares and calculates your income tax as per the New Section115 BAC (New and Old Tax Regime)

2) This

Excel Utility has an option where you can choose your option as New or Old Tax

Regime

3) This

Excel Utility has a unique Salary Structure for Government and Non-Government

Employee’s Salary Structure.

4) Automated

Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the

F.Y.2000-01 to F.Y.2020-21 (Update Version)

5) Automated

Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

6) Automated

Income Tax Revised Form 16 Part B for the F.Y.2020-21

7) Individual Salary Sheet