EPF vs PPF vs VPF: Employees' Provident Fund (EPF) and Public Provident Fund (PPF) is viewed as one of the most preferred retirement funds arranged investment choices in India. EPF is a good investment as it gets opened once one gets utilized.

EPF vs PPF vs VPF: Employees' Provident Fund (EPF) and Public Provident Fund (PPF) is viewed as one of the most preferred retirement funds arranged investment choices in India. EPF is a good investment as it gets opened once one gets utilized. Be that as it may, PPF is a willful investment alternative where a speculator decides to contribute by opening a PPF account. Both EPF and PPF are sans hazard however in EPF, the Center reports interest rate on a yearly premise. InPPF, the central government declares an interest rate on a quarterly premise. Recently, the EPF interest rate for FY 2019-20 has been declared at 8.5 % while the PPF interest rate for January to Walk 2021 is 7.1%.

You may also, like:- Automated Income Tax Revised Form 16 Part A&B and Part B for the Financial Year 2020-21[This Excel utility prepare One by One Revised Form 16 Part A&B and Part B]

Talking on EPF vs PPF, SEBI enlisted assessment and investment the "EPF is opened by the spotter and both business and Employee's contributes in the EPF account each month. Be that as it may, PPF is a deliberate account and it very well may be opened by any Indian resident. Both turn out revenue charge exception under Section 80C of the Annual Duty Act (ITA). Aside from this, this Rs 1.5 lakh roof is the complete aggregate put resources into different plans recorded in Section 80C of the ITA."

The PPF financial specialists are the individuals who need to contribute with zero dangers and aggregate abundance for their retirement fund

You may also, like:- Automated Income Tax Revised Form 16 Part B for the Financial Year 2020-21[This Excel utility prepare One by One Revised Form 16 Part B]

PPF vs EPF;

For the individuals employees who are utilized, they should go for the Willful Provident Fund (VPF) rather than PPF. In this alternative, one will have the option to get 8.5 % on one's yearly investment with the very advantages of EEE that a PPF account will give. In any case, on VPF investment, the scout will undoubtedly go for a similar month to month EPF commitment that the representative has picked. In the event that a Employees picks VPF, the enrollment specialist need not compensation the month to month commitment like EPF, in light of the fact that a scout will undoubtedly contribute on EPF commitment over 12% of the essential compensation of a representative."

Featuring the advantage that an Employee will jump on picking VPF rather than PPF. The Employees won't get the coordinating sum from manager's month to month commitment that the person gets on account of EPF account, however, it will help get the yearly interest of 8.5 % rather than 7.1 % PPF interest."

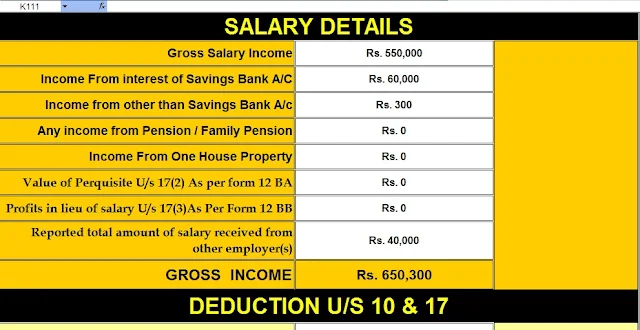

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Income Tax Form 12 BA

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Non-Govt (Private) Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount in to the in-words without any Excel Formula

Aside from this, that EPF gives more prominent return than some other danger-free government-upheld little investment funds plans. The one will have one account to profit of Section 80C advantage while Annual Expense form (ITR) recording that is additionally an advantage to document ITR easily.

On the most proficient method to pick VPF, "Toward the start of the monetary year for example in the long stretch of spring or April or at the time enrollment, one can educate the HR about wishing to select VPF alongside EPF."

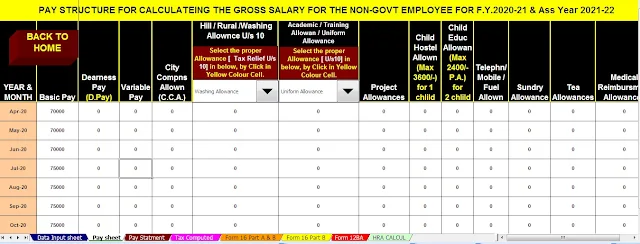

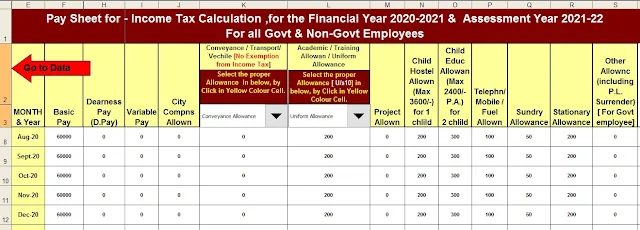

Feature of this Excel Utility:-

1) This Excel Utility Prepare Your Income Tax as per your option U/s 115BAC perfectly.

2) This Excel Utility has the all amended Income Tax Section as per Budget 2020

3) Automated Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E from the F.Y.2000-01 to F.Y.2020-21 (Updated Version)

4) Automated Calculation Income Tax House Rent Exemption U/s 10(13A)

5) Individual Salary Structure as per the Govt and Private Concern’s Salary Pattern

6) Individual Salary Sheet

7) Individual Tax Computed Sheet

8) Automated Income Tax Revised Form 16 Part A&B for the F.Y.2020-21

9) Automated Income Tax Revised Form 16 Part B for the F.Y.2020-21

10) Automatic Convert the amount in to the in-words without any Excel Formula